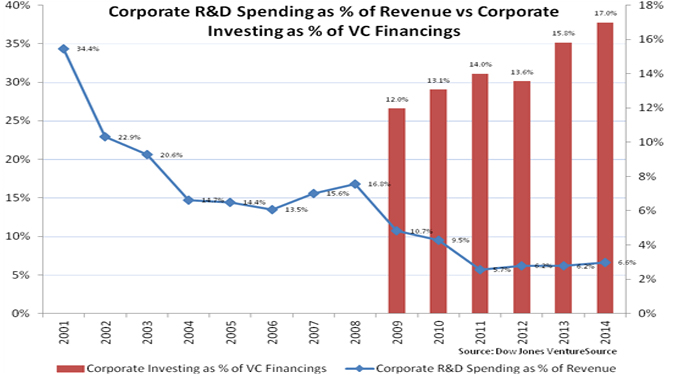

Research and development (R&D) spending isn't the sole indicator of how a nation, region or industry will perform. It is, however, a fundamental contributor to economic growth - along with such factors as science, technology, engineering and mathematics education levels, capital markets, healthcare, infrastructure, property rights and immigration policy. According to Dow Jones VentureSource, corporate R&D spending in the United States has been on a steady decline since 2001, falling from 34.4% of revenue in 2001 to 5.7% in 2011. By 2014, R&D spending recovered a bit, but still remained below 7.0%.

The causes for America's private-sector R&D stagnation are complex, ranging from impatient investors and uncertain returns on investment to economic policy uncertainty and reduced federal funding. Given the precipitous drop in research and development spending, it would be easy to conclude that the United States is in danger of losing its spot as the undisputed world leader in research and development.

However, this week's chart shows a more complex story, with corporations shifting money once devoted to in-house R&D towards corporate venture funds that invest in start-ups with promising technologies. Corporate investing as a percentage of overall venture capital financings has steadily been on the increase since 2009. Despite their shrinking R&D budgets, corporations seek to continue to access innovative, disruptive technologies. Venture capital serves as an efficient vehicle that enables corporations to stay abreast on technology trends and explore potential acquisition targets when they deem it appropriate.

Using these venture capital investment arms as a direct replacement for traditional R&D departments allows corporations to invest at a point when technologies are partially de-risked and somewhat proven rather than at the conceptual phase. This migration in R&D spend has changed the risk profile of corporate research and development while creating a unique opportunity for venture capital investors.

Key Takeaways: While corporate venture capital investing is not new, its recent growth serves to strengthen the potential for a merger or acquisition as an exit opportunity for many venture-backed companies. In fact, according to Crunchbase.com, about one-third of corporate venture-backed startups have been acquired versus 10 percent of startups with funding from only private venture capital. Corporate venture arms have expanded the exit environment for venture-backed companies. This dynamic should reduce the industy's reliance on the IPO market, serving to somewhat smooth out venture capital returns over time.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.