Manager of the Decade — Core Plus Bond Strategy

Our tailored investment strategies incorporate a unified investment philosophy and process across the fixed income risk spectrum.

Experience, Performance and Stability

35

Year Track Record as an Independent Business

$35.1B

Assets Under Management

as of 3/31/24

- $24.8B Insurance

- $2.0B Separate Accounts & Commingled Funds

- $8.3B Advisory

38

Investment Specialists & Professionals

Thought Leadership & Market Insights

Corporate Earnings Shift into High Gear

April 22, 2024

Diverging Interest Rate Sensitivities

April 18, 2024

Investors Focus on Risks in the Middle East

April 15, 2024

Not So Extraordinary BABs

April 11, 2024

U.S. Labor Market Remains Red Hot

April 8, 2024

Bond Market Overview - 1st Quarter 2024

March 31, 2024

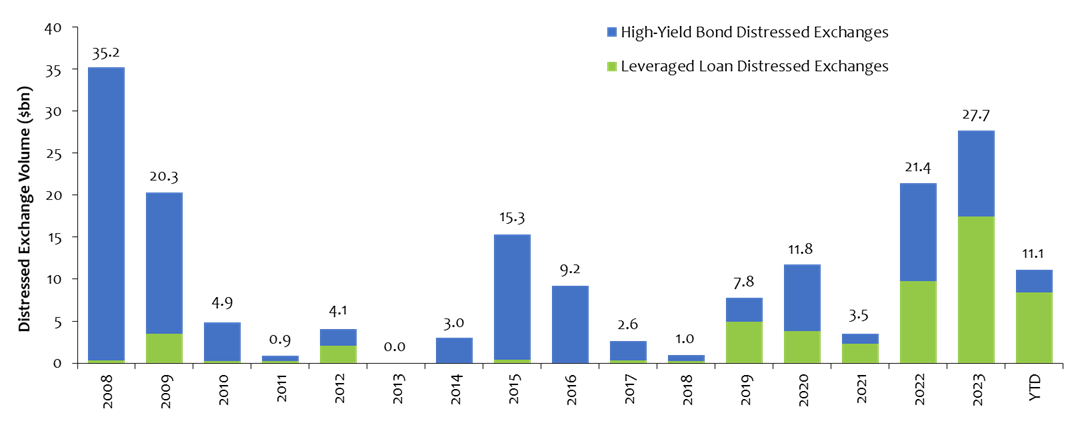

A Bull Market in LME

By Greg Zappin | April 25, 2024

Subscribe to Our Publications

Thank you for signing up for Penn Mutual Asset Management publications. You will receive an email shortly, please follow the link to verify your subscription.

I am interested in:

- Blog

- Market Commentary

- Viewpoints

For strategies information, please contact us.