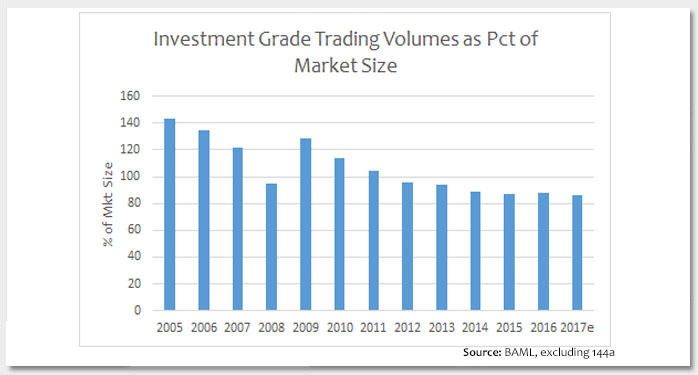

Since the financial crisis, investment grade corporate bond trading volumes have almost doubled. 2017 volumes are projected to total $4.1 trillion, compared to $2.1 trillion in 2007. However this doesn’t tell the whole story – the size of the overall market has tripled over this time period. As a result, liquidity, measured as volumes relative to the overall market, is down quite meaningfully. Today’s chart shows that volumes currently represent 86% of the market while in 2007 they came in at over 120%. This steady decline is due to numerous factors, but a large contributor is the increased regulatory oversight, most notably the Volcker rule which has limited bank investment capabilities.

However, market-based measures of liquidity are robust. With central banks globally seeking to spur investment via accommodative policies, the unprecedented low rate environment has encouraged a widespread reach for yield. The depth of the bid in the market has caused investors to add normally illiquid off-the-run credits and maturities to pick up spread. This would include older, higher coupon maturities and/or credits not widely followed. As a result, we have seen the on-the-run/off-the-run spread basis compress with dealers more than willing to add illiquid off-the-run bonds to feed the yield appetite. The investment grade corporate index now sits at +110 OAS, near 10-year tights. Likewise, the spread difference between BBB and single-A corporates has compressed to 50 basis points (bps), very close to the 5-year tights of 41 bps.

It appears that the unintended consequence of more regulation (reduced liquidity in corporate credit markets) has largely been offset by global central bank easing and the reach for yield. The question is: to what extent has the accommodative policy masked a potential liquidity issue in the corporate credit market?

Key Takeaway:As we near the possibility of a rising rate environment and/or increased fixed income outflows, it will be interesting to observe market behavior under our new regulatory construct. I do not mean to imply that liquidity will vanish. Investors have had a lot of lead time to prepare for such market change. But our current regulatory climate has not lived through the numerous potential market gyrations, and the onset of an episode of illiquidity in the market may provide investors attractive opportunities.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.