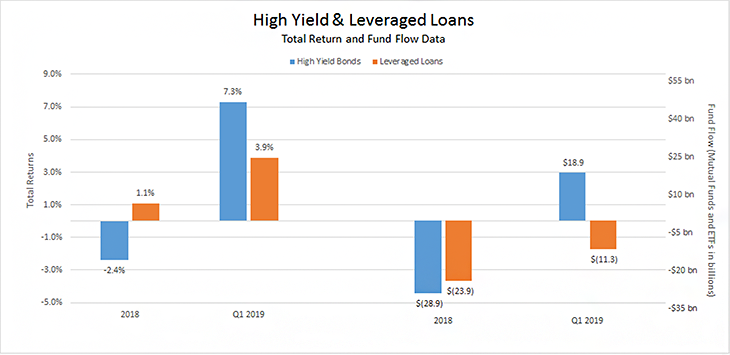

Following a very strong performance on both an absolute and relative basis throughout 2017 and 2018, leveraged loans underperformed high yield bonds by over 300 basis points (bps) during Q1 of 2019. The once-popular asset class among issuers and investors came under pressure as the Federal Reserve (Fed) made its dovish pivot in December 2018, and subsequently reinforced this paradigm shift at the FOMC March meeting. During the meeting, the Fed indicated no rate hikes are expected in 2019 and forecasted only one in 2020. With the market starting to anticipate Fed patience, 10-year Treasury rates declined about 80 bps from mid-November through the end of March. As a result, the appeal dissipated for Libor-based floating rate assets, such as leveraged loans, leading to outflows from loan ETFs. In addition, collateralized loan obligation (CLO) creation slowed (the primary buyer of loans), which exacerbated the supply/demand equation.

Compared to unsecured and subordinated debt, historically the reason to own leveraged loans was their relative defensiveness due to being higher up in the capital stack. The narrative over the past few years centered on their attractiveness as a hedge against rising interest rates. The loan market was in such demand that it doubled in size over the past 10 years, growth that far outpaced high yield bonds. It was a seller’s (issuer) market characterized by limited covenants, higher leverage and narrow spreads. Loan-only structures ballooned with the market wide open. These factors have led to speculation about credit quality in the loan market.

While underwriting standards are a concern, it shouldn’t taint the entire asset class. A bigger concern, in my opinion, was evident during 2018’s fourth quarter selloff when liquidity was extremely poor. This was a good test scenario of what could happen if the economy does go into recession, except the pain will be much worse.

Key Takeaway

With the shift in Fed rate hike expectations, the loan asset class has lost its luster. In some cases among the larger liquid loans, the loans trade at lower dollar prices and 50 bps cheaper than their secured bond counterparts. This dislocation presents opportunities as the relative attractiveness of loans has improved. Similarly, leveraged loans’ close companion, CLOs, have also lagged, causing certain tranches to look cheap relative to corporates and other structured asset classes.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.