In December 2016, the commercial mortgage-backed securities (CMBS) market officially adopted risk retention rules as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The rules were designed to promote an alignment of interests between sponsors and investors. Risk retention requires lenders originating loans to retain a 5% slice of each CMBS deal for five years, thereby forcing issuers to have ‘skin in the game.’

Risk retention has been the biggest regulatory risk the CMBS industry has faced since the financial crisis. Initial fears were largely overblown as the market has successfully implemented these rules with 27 compliant conduit and single-asset, single-borrower deals priced in 2017.

Risk retention deals have come to market in various forms with three being most prevalent in the marketplace. The most common thus far has been a vertical structure, which requires the issuer to retain a 5% interest across all of the bond classes. In a horizontal structure, a 5% strip at the bottom of the capital structure can be retained by a third party, B-piece investor. A third option is an “L” shape, which is a combination of a vertical and horizontal structure.

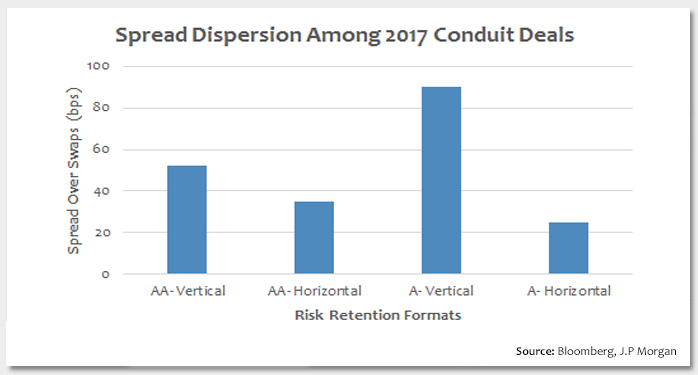

This week’s chart highlights the spread ranges among conduit deals priced in 2017 with a vertical or horizontal structure. For AA- and A- rated securities, horizontal structures generally have less spread dispersion than vertical risk retention deals. In some cases the relative spread between the two structures may be inconsistent given the underlying credit fundamentals of each deal.

Key Takeaway:In today’s tight spread and low interest rate environment where risk assets have been outperforming, the search for relative value opportunities continues to be challenging. For bottom-up credit investors, there could be incremental value in vertical risk retention deals over horizontal deals. In the post-risk retention era, I would expect spread variances among risk retention forms to converge over time as investors become more comfortable in analyzing the structures.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.