Student loan asset-backed securities (ABS) continue to be one of the most unloved sectors in structured credit. Many institutional investors avoid the sector altogether due to policy risk and concern that broad actions by the Consumer Financial Protection Bureau (CFPB) could lead to material amounts of principal forgiveness and term extension. Under the Obama Administration, the CFPB never took steps to implement large scale principal forgiveness and stated they had no intention of doing so. Under the new Trump Administration, this type of policy shift is even more unlikely, as regulators have been moving the other direction and scaling back their interference in certain aspects of the financial markets. However, the CFPB was successful in working with servicers to improve their operations and communications with borrowers, which has led to increased involvement in modified repayment plans for borrowers. In general, this has lengthened the terms of the underlying loans.

This activity has led to some downgrades in the sector, as certain rating agencies became worried that debt tranches wouldn’t be paid off before the tranches reached their legal final maturity dates. Navient, one of the largest servicers in the private student loan credit space, worked to counter these downgrades by calling its deals in some cases and gaining bondholder approval to extend the legal final maturity dates in others. However, the rating agencies have been slow to reverse the downgrades, even after the success of these legal final maturity extensions.

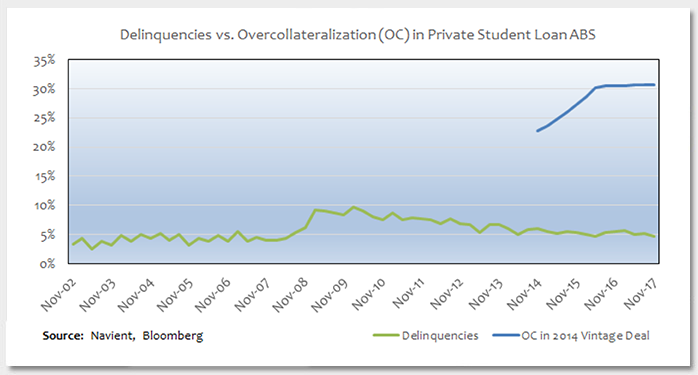

From a credit perspective, the trusts in the private student loan space -- particularly those issued by Navient and Sallie Mae -- have demonstrated very high credit quality. The underlying borrowers are typically characterized by prime FICO scores and high co-borrower support, with co-borrower percentages sometimes even exceeding 90%. This week’s chart also shows how delinquencies in the space have stabilized over the past 15 years, while the overcollateralization in post-crisis private student loan deals builds quickly and remains high. This removes some of the credit concern in the sector and allows investors to focus on the question of how to model prepayments in an extending asset class. While this sector has participated in the broad rally in credit, there are still some unique convexity opportunities in this space, particularly in legacy Federal Family Education Loan Program paper, where bonds can still be offered at attractive discounts.

Key TakeawayThe policy risk associated with student loan ABS is frequently misunderstood -- enough to keep some investors out of the sector altogether. However, digging a little deeper on the sector often reveals clean credit profiles and improving fundamentals. Extension risk has become a more prominent concern as more borrowers take advantage of modified repayment plans. If investors can get comfortable with how to appropriately model prepayments in the sector, then the asset class has something to offer to investors who continue the difficult search for value in the current fixed income environment.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.