The U.S. High Yield market (USHY), as represented by the JP Morgan Domestic High Yield Index, quietly returned almost 19% in 2016, outpacing stocks in the S&P 500 Index, which are up approximately 12%, and the Dow Jones Industrial Average, up approximately 16.5%. There are many constantly changing variables that factor into market returns. However, I wonder if even without being able to identify and correctly forecast every variable, was there a way to predict the odds of an outsized return for the USHY market at the start of 2016?

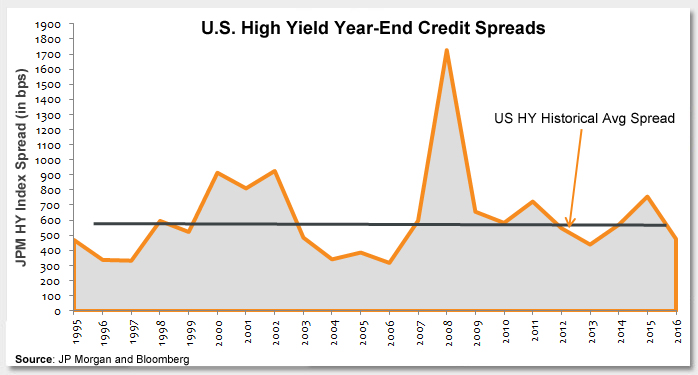

For some insight, let’s take a look at credit spreads of the U.S. High Yield Index at the start of the year. Credit spreads are how the market measures and compensates investors for default risk and the probability of losses given default. The wider the spreads are, the more risk the market is pricing in. If those levels of defaults and losses don’t materialize as much as the market is pricing in, it can create fantastic returns, such as the ones experienced by USHY in 2016. Looking at this week’s chart, we can see that credit spreads at the start of 2016 were more than 750 basis points (bps). That compares to the historical average spread for USHY of closer to 590 bps (for context, that compares to the wides of roughly 1,725 bps in 2008 and the tights in 1997 and 2007 of around 311 bps. This means at the beginning of 2016, the market was pricing in higher defaults and/or larger losses given default than was typical. As the credit cycle began to extend and commodity prices moved higher (providing the potential for stronger earnings for a lot of the distressed industries), credit spreads began to move tighter to finish the year at 476 bps. This spread tightening as risk was being repriced led to the index’s strong returns.

Key Takeaway:Knowing that spreads at the start of 2016 were wider than normal didn’t necessarily mean that it would be the year for spreads to revert back to normal. The market could have kept moving wider, out to the levels seen in 2008. However, spreads outside of 700 bps for USHY are attractive entry points, and historically have led to strong returns in subsequent years. The contrary is true as well. When spreads get near the tights (low 300 bps), it seems to lead to lower returns in subsequent years. USHY spreads ended the year at 476 bps, inside of the long-term average spread for the index. Where can we go from here? Is the juice worth the squeeze?

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.