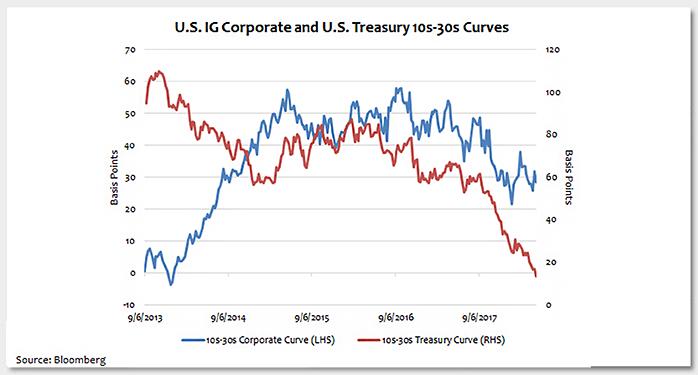

Long end corporate credit spread curves have been somewhat range bound in recent weeks off the tights experienced in late January. The January print for the 10-year to 30-year curve was 21 basis points (bps) in the Bloomberg Barclays U.S. Corporate Index. This is the flattest the long corporate curve has been since 2014, as shown in today’s chart.

This trend in the long corporate basis has coincided with the continued flattening in the long end of the Treasury curve, which now sits at just 13 bps. The last time the long corporate curve was in its current range of about 30 bps, the Treasury curve was significantly steeper. At that time, the 10s to 30s Treasury curve was in the mid-70s bps.

The absence of significant long corporate curve flattening can be explained on several fronts. Aside from the flat Treasury curve, another meaningful factor is the large amount of long bond corporate issuance so far this year. Through April, $100 billion of non-financial bonds with maturities of more than 10 years have been issued, compared to $64 billion in the same period last year. This issuance was 23% of supply in the YTD 2018 period, relative to 15% in 2017. 10-year and 30-year Treasury yields at the time of this writing are at 3.07% and 3.20%, respectively (up a substantial 66 and 46 bps from year-end 2017). As a result of the flat Treasury curve, corporate issuers have looked to print more long end paper. Foreign demand of long corporates has also diminished; currency hedging costs for overseas buyers have increased to the point that all-in yields are not as attractive as they once were. Additional Federal Reserve tightening will likely move hedging costs even higher and further lessen the appeal of U.S. credit to the foreign buyer.

Key Takeaway

As the long end of the Treasury curve continues to flatten, the corporate credit curve has remained relatively range bound. New issue supply and currency hedging costs are headwinds for a flatter long credit curve, while rising long rates will likely increase the bid from pension plans and insurance companies. Likewise, tax reform is expected to drive deleveraging, which should result in lower corporate issuance, especially in the long end and supportive of spreads. The BBB rated curves currently appear to be at the steeper end of the recent range while single As are at the flatter end. Certainly, credit curves are often steep for a reason – increased leverage for M&A, long-term industry challenges, specific operational challenges – but as rates rise, the potential exists for modest flattening of corporate credit curves in the near term, led by BBBs. However, keep an eye on the long Treasury curve. The last time the Treasury curve was this flat was in the summer of 2007. Further flattening, or an inversion, will likely elevate volatility.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.