My first “real” job was delivering The Post-Star, a daily newspaper that still serves the upstate New York town where I grew up. It doesn’t seem like newspaper delivery fills that first job role anymore, and the reasons for this are many. One of the biggest contributors has been the shift in the way we consume media today. Not too long ago, print, TV and radio were the primary ways we stayed informed. We now live in a multi-screen world where digital media is playing an increasingly important role as a source of information. Many of us have multiple devices from which we consume media both inside and outside of our homes.

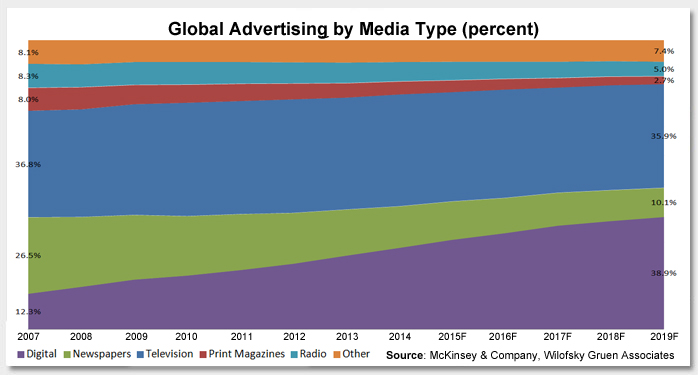

A way to quantify this shift is by looking at advertising spending over time. Advertising dollars are typically spent in the media channels where they are most impactful. “Typically” is the key word, as both legacy media (newspapers, magazines and radio) and their revenue sources (advertisers) have been somewhat slow to adapt to the shift. As a result, the demise of legacy media, first predicted almost ten years ago, has turned out to be premature. It is clear, however – and this week’s chart clearly illustrates this point – that the move toward digital media is occurring swiftly and at the expense of legacy media.

It’s not just print media and radio that is affected by this shift. The way that we view content on our TVs is changing too, though it’s not yet reflected in TV advertising as a percentage of total media spend. New “Smart” TVs are now extensions of our phones, tablets and PCs, complete with internet browsing and access to streaming services such as Netflix, Amazon, YouTube, hulu, Spotify, Pandora, Pluto TV, etc. These services enable consumers to “cut the cord” and take almost total control over the content they consume. While it is not unusual to have older content available on-demand, content providers such as Netflix and Amazon have released entire seasons of new programming, allowing consumers to “binge watch” the new season of their favorite shows without all the commercials. This shift will certainly change how advertisers approach their campaigns in the future.

Key Takeaway:While digital media has not made traditional media obsolete, as has often been predicted, digital has grown and will become the largest global media type by 2019. The shift will continue to create both winners and losers as the landscape continues to evolve. Traditional media companies have noticed the digital trend and pursued mergers and acquisitions (M&A) to help compete in this new dynamic (notable examples include AT&T / Time Warner and Comcast / NBC). It will be interesting to see where digital media goes in the future. As Bob Dylan sang in the title track of his 1964 album, “The Times They Are A-Changin’.”

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.