In spite of domestic political unrest and continued geopolitical uncertainty, the markets have enjoyed a surprising amount of stability since September 2016. Spreads have continued to grind tighter and tighter, begging the question, “how low can you go?” When spreads are at the tights across most sectors, cross-sector relative value becomes a more important form of differentiation between investments – and definitely more interesting during a summer of weak supply and low market volatility!

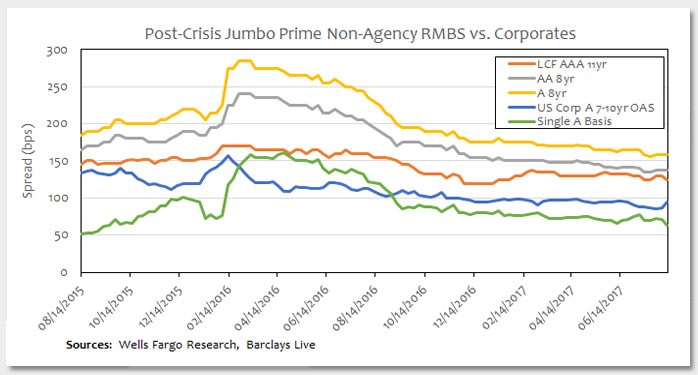

This week’s chart compares spreads for post-crisis jumbo prime non-agency residential mortgage-backed securities (RMBS) with that of single A rated corporate bonds of a similar tenor. The adage of “structured always trades cheap to corporates” continues to hold, but the basis between the two definitely shows signs of compression since the wides in the first quarter of 2016. Corporate credit spreads snapped back rather quickly after the peak of worry in early 2016, while RMBS spreads didn’t really come back in line until September 2016. However, since then RMBS spreads have grinded tighter faster than their corporate counterparts, compressing the basis between the two. This basis looks like it’s approaching what it was two years ago – around 50 basis points (bps).

Post-crisis jumbo prime RMBS offers a number of benefits that have attracted investors to the space. The credit quality of the underlying borrowers is outstanding, with one recent deal boasting a weighted average FICO score of 781. The post-crisis deals have structural protections that their legacy counterparts did not enjoy. The rating agencies now model stressed scenarios based on the experiences of the financial crisis. Additionally, as these deals season, the credit enhancement tends to build nicely, and rating agencies have given credit to this dynamic in terms of regular rating upgrades.

Key Takeaway:

Since the wides in spread in the first quarter of 2016, most sectors have continued to grind tighter. This decrease in spread has caused renewed interest in certain structured areas that still offer decent yield. This week’s chart highlights the basis between non-agency RMBS and corporates as an example of this phenomenon. The continued hunt for yield amid tight spreads has caused the basis between these two sectors to compress. Post-crisis jumbo prime RMBS offers a number of attractive features that have renewed investor interest in the sector.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.