The derivative market is vast, with notional value estimated to be between $500 trillion and $750 trillion. Since the crisis, there have been three major changes in derivative markets:

- Before the financial crisis, the majority of derivatives were trading over the counter; therefore, counterparty risk was a big consideration during the crisis. To reduce counterparty risk exposure, regulators required many derivatives to trade/clear on the exchange. This significantly reduced the counterparty risk exposure in the market, and also made the market transparent and competitive.

- As the market becomes more transparent and competitive, it reduces the attractiveness of market-making activities. Due to lower profitability, less capital and resources are allocated to market-making activities.

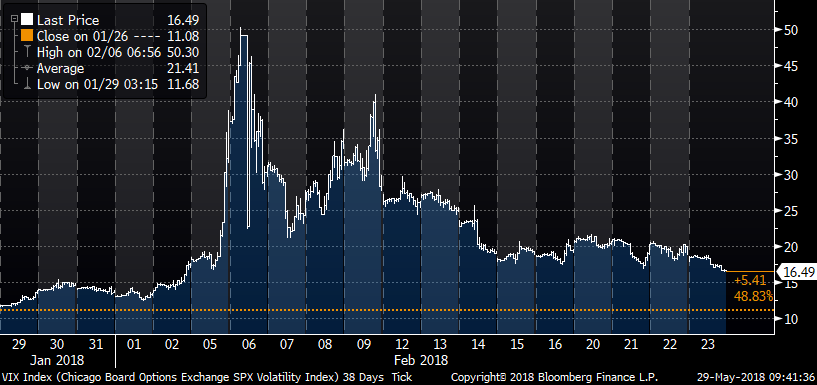

- To improve profitability, more and more market-making is being done by machines. The algorithm excels at hedging the trades at lightning-fast speed; however, without enough capital behind it, the market cannot absorb a large volume of trades and is prone to make big moves. As a result, we saw flash crashes: in the treasury market in October of 2014, in the equity market in August of 2015 and in the volatility market in February of 2018.

These developments have two implications in the market.

The first implication is how market liquidity interacts with volatility. It is common for liquidity to dry up when the market is volatile, but it is much more so nowadays. Also, when higher volatility leads to lower liquidity, it can worsen the volatility. To manage risk using derivatives, investors not only need to think in terms of what position to initiate, but if it is possible to unwind the position during volatile markets.

The second implication is how investors should react during those flash crashes. As the last several years have shown, you are better off doing nothing during the flash crashes -- the market recovered every time. Will this still be the case as the credit cycle ages?

Key takeaway

The liquidity landscape in the derivative market is changing. When the market is calm, liquidity is abundant and the bid/ask spread is very tight. However, during volatile markets, liquidity can evaporate quickly, and the bid/ask spread will widen significantly. It is important to manage the derivative position with a sound exit plan during these times.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.