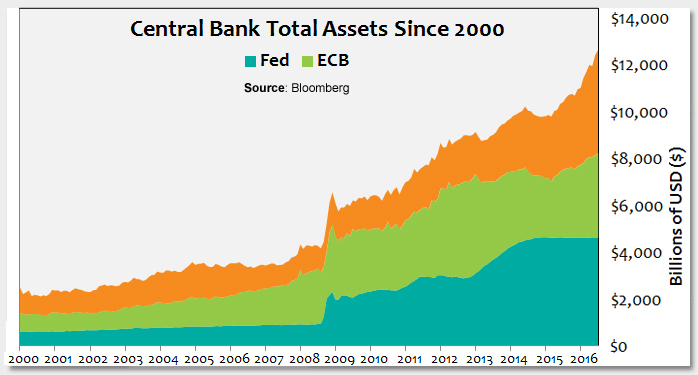

Since 2009, the global central banks have embarked on aggressive monetary easing. This week’s chart shows how much the major central bank’s balance sheet has grown in that time. As of today, the 10-year U.S. treasury is trading at 1.58%, 10-year UK Gilts at 0.57%, 10-year German Bunds yield at -0.04%, and 10-year Japanese Government Bonds yield at -0.11%, all while inflation is still way below target and gross domestic product (GDP) growth is still anemic.

If the original goal of monetary easing was to stimulate growth and inflation, we can say it has failed. The question is: Do investors want the central banks to succeed eventually?

My thought is, if we want higher asset prices, it is better that central banks don’t succeed at driving up inflation or growth.

The driving force behind the recent rally of risk assets is the extremely low yields. Retirees, pension funds and insurance companies’ income needs don’t go down just because the central banks are buying bonds; on the contrary, lower yields increase the present value of future liabilities. Lower interest rates force investors to take on more risk to maintain the income. This incremental risk taking among investors drives risk assets higher.

At this moment, both equity and bonds are trading close to record highs. What is the biggest risk to the asset valuation? It is if inflation or growth finally picks up, which will drive long-term interest rates higher, and, because the low yield is the foundation of the current rich asset valuation, asset prices will come down when rates start to go higher.

In the U.S., we are seeing a cyclical upswing in the economy and inflation data has been firm this year. Globally, we are seeing more talk about fiscal policy and the limit of monetary policy. If the baton of economic stimulus is passed from monetary policy to fiscal policy, either inflation or growth will grow.

Individual investors have been buying utilities, telecoms, consumer staples, REITs and high quality corporate bonds. These are all assets that do well in a disinflationary environment. The valuation of these sectors is higher than the valuation of the S&P 500 Index, even though these low-growth sectors historically tend to trade at a discount to the Index. I think these sectors are very risky and expensive. Investors need to think about a different scenario, a scenario with less deflation fear, even some inflation concern. Commodities, emerging markets, and financials are assets that should do better in this scenario.

Key Takeaway:The central banks are in a difficult spot. Their success will lead to market volatility, while failing to achieve their goals is not a good outcome, either. A balanced/diversified portfolio should perform fairly well in different macroeconomic environments. For a portfolio that overweights deflationary assets that have performed well and are trading rich now, rotating into inflationary assets that are trading cheaper may be a good way to diversify.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.