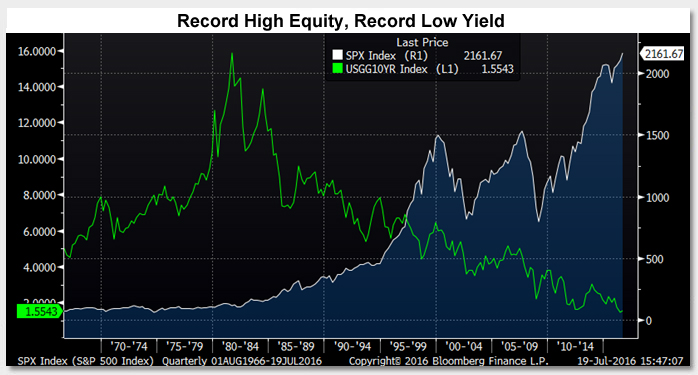

U.S. equities are trading at record highs, while interest rates are close to record lows. This week’s chart shows the long bull market in bonds over the last 40 years, as well as the rare combination of record high equity with record low interest rates we are currently observing.

This bull market is already the second longest in history. However, if you talk to investors, you won’t feel it. There is much more nervousness among investors than exuberance. The current bull market is driven more by a necessity to earn reasonable income and a fear of underperforming than by the greed to get rich.

The skittishness of investors following recent events is easily understood: a 2% GDP growth rate, stagnation in Europe and Japan with few monetary tools left, leverage in China, stress among commodity exporters, plus the Brexit. Central bankers see it too, and it turns out cautious central bankers are the best friends of risk markets. Every time the market becomes volatile, we see an immediate response from central banks. Every mini-crisis leads to higher equity prices and lower rates.

Another dynamic that supports U.S. equities is the relative strength of the U.S. economy compared to every other country in the world. The dollar has been very strong in the last few years because of this fundamental. A strong currency has increased the allure of dollar-based assets.

Combining these two strengths, we are getting some similar elements to the late 90’s. During that time, a strong dollar and the allure of the technology industry attracted capital inflows from all over the world; Greenspan Fed reversed the rate hiking and cut rates in 1998 to calm the financial markets after the emerging market and long-term capital management crisis, even when the domestic economy was doing well. The equity market boomed afterwards.

I see some possibility for this scenario to happen again, but, the global economy is much weaker now, and central banks have much fewer tools left. China provided a significant tailwind for the global economy in late 90s, but that is no longer the case. This “neo-90s” scenario won’t be my base scenario. Low single digit return for the next several years with bouts of volatility is still my base scenario.

Investing in this environment is challenging. There is not a lot of value to buy in the marketplace, and cash yields almost nothing. On the other hand, the extremely cautious Fed makes shorting anything a bet against their power to influence market. At this moment, the central banks can still influence the market.

Key Takeaways:Market participants and central bankers are worried about the “Japanization” of the world economy. This shows up in extremely low interest rates and rich asset valuation, especially in defensive and high dividend sectors. The risk to this market consensus is either inflation or growth surprises on the upside. If that happens, asset prices will have to re-price.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.