As total return investors, we are always trying to identify undervalued investments that have a catalyst to appreciate to what we believe is fair value. In the current market environment, credit spreads have performed very well across most risk markets this year, and attractive opportunities have become more difficult to identify. Following Donald Trump’s election as the next President, everyone is trying to forecast potential market winners and losers. Some sectors were quick to react; healthcare and banks in particular. Reading the tea leaves, I see the refining sector, which is somewhat under the radar, as a potential big beneficiary. Carl Icahn’s editorial in the Wall Street Journal this November got me thinking that the industry may be poised to rally if it can obtain the regulatory relief that he is lobbying for.

Refining equities have performed poorly in 2016 as lower revenues and higher costs have pressured margins. Renewable Identification Numbers (RINs) are one of the costs impacting the sector, but they have not been discussed in the mainstream until recently. A RIN is an electronic credit that was created as part of the Renewable Fuels Standard (RFS) which required refiners, importers or blenders of fossil fuels to blend more renewable fuels, such as ethanol. This requirement was intended to be environmentally friendly, deter oil imports and increase demand for corn to farmers. On the surface, this seems logical. However, independent refiners often cannot add biofuels to their products because of the costs associated with doing so. As a result, they are then required to buy a per-gallon credit from other refiners, importers or blenders who are able to make the blend.

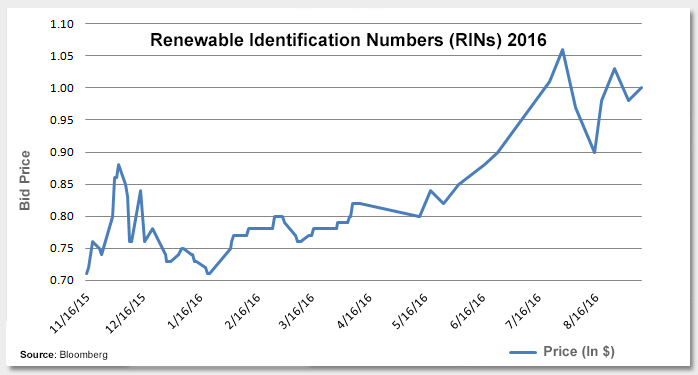

Companies that can blend the renewables without significant incremental costs to their business, including larger oil companies and gas stations, do so and generate the RINs which can then be sold to independent refiners who are forced to buy the credits. Wall Street hedge funds are aware that this system creates forced buyers and have bought RINs in an effort to sell them at higher prices to these independent refiners. This can artificially inflate the price of RINs and significantly increase the cost of production for independent refiners. This week’s chart illustrates how the cost has escalated materially this year. What is not shown is how much lower the cost was when the RFS was first put in place (per the Icahn Op-Ed in the WSJ, “in 2012, each credit cost a penny”). This increase has understandably crimped refining margins.

Key Takeaway:Looking ahead, it seems plausible that the next head of the Environmental Protection Agency (EPA) will be a climate-change skeptic. Moreover, Icahn was a strong supporter of Donald Trump and may have his ear on the RIN issue. My bet is that Icahn’s persuasive arguments will lead to some sort of relief for refiners as it relates to RINs. If this relief materializes, independent refiners will be poised for higher earnings, tighter credit spreads and better times ahead.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.