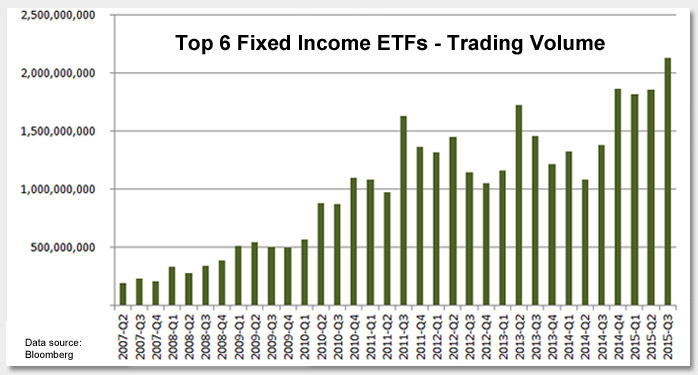

The trading volume of the most popular fixed income Exchange Traded Funds (ETFs) demonstrates a strong, increasing pattern. There are many traditional reasons for this increase in ETF popularity, some of which are below:

- Lower Expense Ratios – ETFs are known for generally having lower and fewer fees than mutual funds

- Quick Beta – ETFs can give instant diversification: exposure to many companies and sectors

- Ease of Large Transactions – It is generally easier and faster to buy $50 million in ETFs than it is to purchase $50 million of bonds

These common reasons were often cited as motivation to utilize ETFs in the past, but based on discussion with the institutional investor community, it appears that liquidity is emerging as one of the more important considerations contributing to the growth in trading volume shown in this week’s chart.

There is a great deal of debate on how to define and determine market liquidity (bid/ask spreads, trading volumes, dealer inventories, etc). For those managing money, however, the bigger issue is that market liquidity has been greatly reduced in both the corporate and structured asset classes, and it is a problem that is getting more difficult to manage.

Key Takeaway: As corporate bond liquidity remains troubling, I expect institutional investors to increasingly turn to fixed income ETFs as a tool for managing their portfolios.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.