Albert Einstein published the general theory of relativity in 1915. The theory explains how the presence of matter bends and distorts spacetime. Until recently, this theory was barely detectable on Earth until new technologies allowed physicists to observe a place where this theory applies at a much greater scale – a black hole. While both the discovery and technology are amazing and impressive, what I find particularly interesting is that Einstein was able to predict this relationship long before he was able to observe it.

Unlike the theory of relativity, the economy is reflective because market participants react. This week’s chart intends to capture the divergence between theory and reality in recent central bank actions to lower deposit rates into negative territory.

The effects, in theory, of a central bank lowering its deposit rate are to:

- Weaken the domestic currency, supporting exports and counteracting deflationary pressures

- Steepen the yield curve, encouraging bank lending

- Lower the floor on nominal short rates, allowing real short rates to decrease further

- Result in stronger equity markets, as investors regain confidence in the central bank’s monetary policy

This theory held up in practice in 2014 when the European Central Bank (ECB) cut its deposit rate from 0% to -0.10% in June and again to -0.20% in September. Over the remainder of 2014 and through the first six months of 2015, the Euro depreciated over 20% against the dollar and European equities rallied.

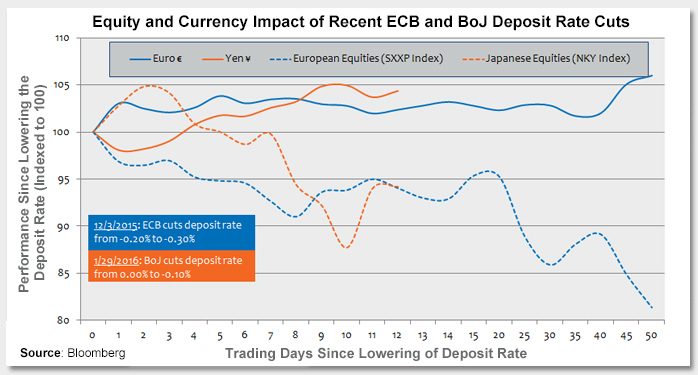

Recent central banks’ moves to lower their policy rate, however, have not produced the same effects. In early December 2015, the ECB cut its rate to -0.30%; less than two months later, the Bank of Japan (BoJ) lowered its deposit rate from 0% to -0.10%. This week’s chart shows the performance of the euro (€), the yen (¥), and European and Japanese equities since each rate cut. So far, the ECB and BoJ’s actions have not had the intended effects, as both the euro and the yen have appreciated against the dollar and equities have sold off.

Key Takeaway: The ECB’s rate cuts into negative territory in 2014 may have caught investors by surprise. The “novelty” of this new central bank policy tool may have been the greatest force contributing to the depreciation of the euro and equity rally that followed. This time around, investors are more wary of the effectiveness of negative deposit rates. Banks now appear less willing to lend and their margins are compressed. On the currency front, the BoJ is facing a strong flight to safe haven assets, causing the yen to appreciate. As a result, I expect further central bank policy actions to be greeted by investors with greater skepticism than before.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.