A few weeks ago, I started to use the car service app Uber after several people recommended it. Now, I use it whenever I can. While its convenience and service cannot convince me of its hefty enterprise valuation ($50+billion), it has converted me to a loyal customer. Another interesting fact I learned is how it is changing the labor market. For less-skilled workers, Uber offers them an opportunity to make more money and have greater flexibility in terms of when they work. As someone who is concerned about inequality and technology unemployment, it is nice to see how technology can help the labor market in a positive way.

Back to the market. In the last three weeks, sentiment has changed sharply. In August and September, the market was worried about a hard landing in China and the U.S. dollar strength driven by the potential rate hikes. On October 2, after the release of a dismal non-farm payroll, the market had a change of heart: Bad news is good again. The thinking goes: If the U.S. economy and labor market slows down, then the rate hike will not happen in 2015, then suddenly the risk-on trade is back on. Besides this, the seasonality is favorable for year-end and the market is still underweight risk.

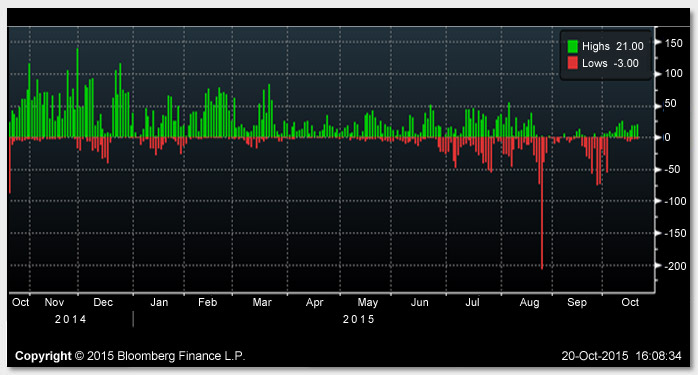

I am doubtful about this rally. It feels more like a short squeeze driven by bad positioning and negative Gamma (a measure of the convexity of a derivative’s value in relation to the underlying instrument) in the market than a genuine rally. This week's chart shows the 52-week new highs and new lows in the S&P 500 Index, which is not a very promising picture.

The market structure has deteriorated in the last few years as more and more money flowed into strategies with a negative Gamma – hedge funds, smart beta, liquid alternatives, volatility-controlled funds, Commodity Trading Advisor (CTAs), hedging activities from insurance industry, etc. These accounts tend to sell on the way down and buy on the way up for risk management purposes. Risk management is a good discipline; however, when a large portion of market participants use similar strategies for risk management, it can be a disaster. The end result is stampede-in and stampede-out, which makes the market prone to V-shape behaviors. Research from JP Morgan's Marko Kolanovic is a good read to understand these dynamics.

This negative Gamma in the market makes risk management more challenging for anyone with a Profit and Loss (PnL) to manage. It creates a lot of false signals, and the market no longer behaves in a typical back-and-forth fashion. Take a look at how many days we were down in a row, and how many days we were up in a row in the last two months. Statistically low probability events happen much more frequently now. How to adjust traditional risk management practice to better fit this new environment is a question we think about all the time.

Key Takeaways: The recent rally is likely driven by crowded positioning and bad market structure, so stay cautious and defensive. Negative Gamma in the market is creating a lot of challenges for asset managers that need to manage risk actively. New reaction functions are needed to better fit the current market environment.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.