With sub-zero temperatures outside, I am driving past Punxsutawney, Pennsylvania, where Phil cruelly sentenced the Northeast to an additional four weeks of winter. In the hope spring may arrive sooner than one pessimistic groundhog is forecasting, I could not help working a baseball reference into my title this week.

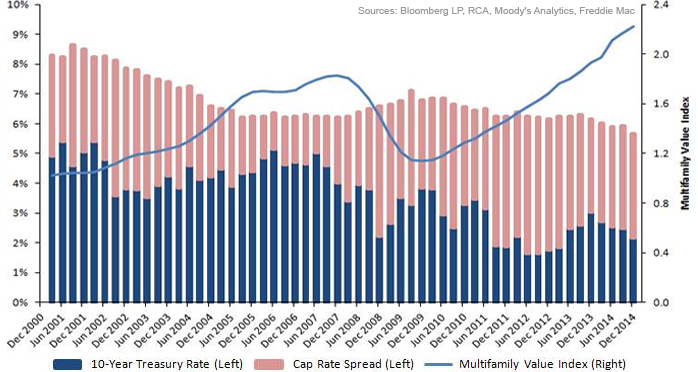

This week's chart highlights a historical perspective on valuations of multi-family properties and capitalization (cap) rates -- a property's income divided by its total value. Cap rates are broken out by showing the ten-year U.S. Treasury yield and adding a cap rate spread, a measure of how much real estate investors are paid above a risk-free rate. Multi-family housing has been the best performing sector of the real estate market since the financial crisis, and, as this chart illustrates, valuations are now higher than their pre-crisis peak.

Despite an already healthy recovery, we believe the multi-family real estate sector in the U.S. is poised for gradually improving valuations over the next five to ten years due to a combination of fundamental and demographic factors:

- Cap rate spreads are priced reasonably; the spread is 350 basis points today versus an average spread of 310 basis points over the past fifteen years. Long-term interest rates in the U.S. are expected to remain "lower for longer," helping to limit upward pressure on real estate cap rates.

- Multi-family vacancy rates are at twenty-year lows, which is clearly supportive of rents going forward. Additionally, the new supply of both single-family and multi-family housing looks to be balanced and in-line with expected demand.

- Trends in the domestic labor market have been gradually improving since the financial crisis. Average monthly payroll growth was $225k during 2014, the highest level since 1999. Better employment conditions combined with pent-up housing demand from Millennials should drive significant growth for multi-family housing.

- Technological advances are dramatically changing the ways Americans shop and work today, which is likely to negatively impact valuations for some retail and office properties. However, demand for better living space will likely never fall victim to disruptive innovation.

Key Takeaway: Despite signs of weakening lending standards within the overall commercial mortgage-backed securities (CMBS) market, we continue to have a positive outlook for the multi-family real estate market. We believe multi-family CMBS offer the best relative value opportunities within both the residential and commercial mortgage fixed income sectors.

And thankfully, pitchers and catchers report this week!

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.