Policy making, corporate strategies and investment styles all tend to move in cycles. In the last twenty years, managing down labor cost has been a winning strategy. On Monday, a New York Times article about how Walmart is getting better results by paying employees more caught my attention. Walmart has 1.4 million employees in U.S., and this strategy change will have ripple effects on labor market.

In the past few months, we have seen several signs that some long-term trends are changing, including:

- On globalization: It was universally considered beneficial for the economy in the last few decades; however, voters are now revolting against it. Brexit, the anti-immigrant sentiment in the Euro zone and the presidential election in U.S. are all signs of this change of heart.

- On fiscal policy: Fiscal policies were seen as the main tool to manage the economy in the 1970s and early 1980s; since then, monetary policies have played a major role in managing the ups-and-downs of the economy. Now, we are hearing more conversation about increasing fiscal stimulus, and more people realize the marginal utility of further monetary easing is very limited at this point.

- On monetary policy: Lower short-term and long-term rates were both considered stimulating for the economy. The Federal Reserve (Fed) completed an “operation twist” in 2011 to drive long-term rates lower, but now this is being reconsidered. The challenge is not just in the U.S., and the Bank of Japan (BoJ) talked about yield curve management in its last meeting. Instead of driving the yield as low as possible, the BoJ will try to keep 10-year Japanese Government Bond (JGB) rates around 0%. A steep yield curve will help financial institutions. This Monday, Fed governor Eric Rosengren posed an idea of raising long-term interest rates while keeping short-term rates unchanged, citing rationale that long-term interest rates are a better tool to manage financial stability than short-term interest rates.

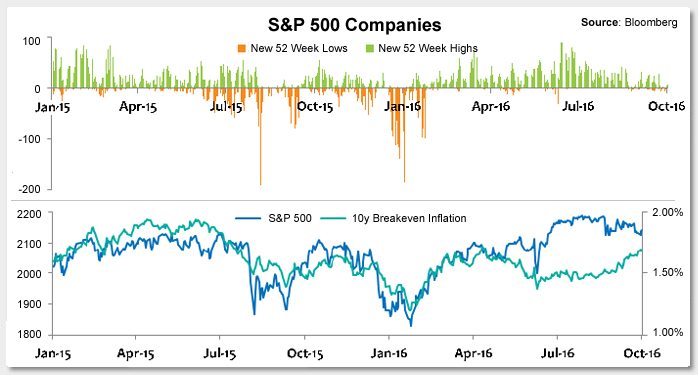

- On inflation: Deflation has been the fear of every central bank. The aggressive monetary easing to prevent deflation has driven a boom for risk markets. Slowly, we are seeing more and more signs of inflation. Breakeven inflation has reached a one-year high, even though the dollar index is close to its five-year highs. Also, the metal, mining and energy sectors are outperforming and defensive. High dividend sectors are underperforming in the last few months, both of which are typical late-cycle inflationary signs. Also, central bankers are showing willingness to run the economy a little hot, so the pressure on inflation is slowly developing.

These factors will have a deep impact on how I look to allocate capital. In short, inflation will slowly pick up. The long-term rate is vulnerable. Cyclical sectors will do better than non-cyclical/high dividend ones, the real economy will do better than financial market and risk markets will not do too well at all in this new environment.

A quick look at the market: currently, the credit market is bulletproof and is trading at the year-to-date tight, while equity markets are showing some sign of fatigue. The dollar has reasserted its strength, and Chinese yuan is trading at a six-year low. Most commodities are up double digits this year, despite the strong dollar.

Since the equity market hit bottom on February 11, 2016, there has been a strong recovery of market breadth. The new high list of the S&P 500 Index has expanded quickly, while the new low list has quickly shrunk. These are all signs of a healthy market. Since July, however, the market breadth has deteriorated; as of today, 0% of stocks in the S&P 500 are at their 52 week highs, and 1.4% of stocks are at their 52 week lows, even though the index is only 2% from its all-time high. This divergence between index strength and underlying weakness usually is a not a healthy sign for markets.

Corporate share buyback programs have been the largest buyer of U.S. equities in the last few years. The old record was set in 2007 with $590 billion buybacks. We have been running close to that pace since 2014. In the recent quarter, the pace of buybacks has slowed because corporate leverage has reached a fairly high level – very high if we adjust for the cycle, because leverage tends to be lower at later stage of the recovery. This slower pace in share buybacks is another negative for equity markets.

Key Takeaways:A lot of secular trends are slowly reversing, and these have deep impact on market performance and capital allocation. Pay attention to inflation market and corresponding data. Previous asset allocation strategies that have worked well in the last few decades will need to be rethought.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.