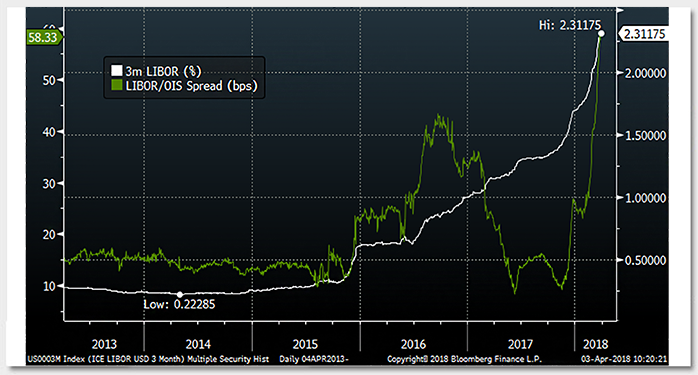

In the recent weeks, London Interbank Offered Rate (LIBOR) has been on a steady uptick. The main reasons for rising LIBOR are:

1) The large increase in U.S. T-Bill issuance that regularly drains funds from the market as the U.S. Treasury funds the growing Federal deficit.

2) The tax-driven repatriation of USD profits from the Eurodollar markets (those outside U.S. borders) to the onshore markets. Usually this means sale of non-government credit and purchase of treasury bills.

3) The increase in U.S. interest rates and the risk that Treasury funding need will grow larger. This forces the market to price LIBOR higher in a precautionary manner, while continuing to price the Overnight Index Swaps (OIS) curve off the basis of Federal Open Market Committee (FOMC) rate expectations.

As seen in the chart above, LIBOR is at a very attractive level – 2.31% – at the time I’m writing this. Higher LIBOR and the current rising rate, late credit cycle environment make high quality floating rate securities appealing. Last month, I attended a panel discussing volatility selling strategies and emphasized that AA/AAA CLOs with about 3.5% yield will make many volatility selling strategies less attractive. Now, with higher LIBOR, these floating rate instruments are looking even better.

Higher LIBOR will increase the funding cost for companies with more floating rate debt. Large corporations in S&P have mostly financed themselves using fixed rate bonds. However, 40% of Russell 2000 companies’ debt is floating rates. This justifies a cautious stance towards small cap companies in general.

Key Takeaway

Rising LIBOR is not a sign of market stress. It is driven by technical criteria. Higher LIBOR makes floating rate securities attractive, so be cognizant of companies with high exposure to floating rate financing in this environment.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.