One of the myths often heard after the 2008 financial crisis is that corporation balance sheets are stronger than ever. It is true that corporate liquidity -- which is measured by cash position and debt maturity profile -- did improve; however, corporate leverage, an important indicator of balance sheet strength, has recently reached a record high. Unfortunately, higher is not healthier.

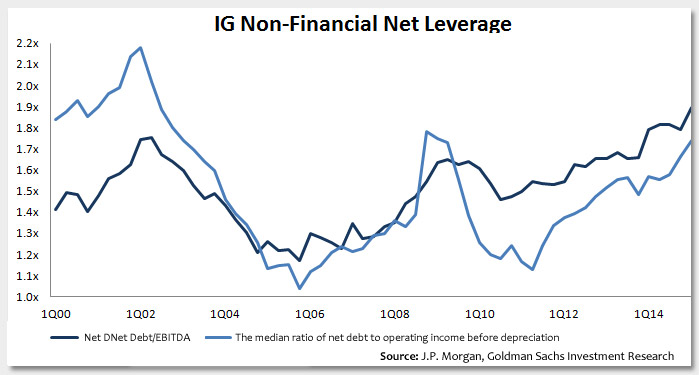

This week's chart shows the ratio of net debt to EBITDA (earnings before interest, taxes, depreciation and amortization) for non-financial firms, the most commonly used metric for net leverage. This metric climbed to a 15-year high, to 1.91, in the first quarter of this year, according to J.P. Morgan. The ratio was at 1.35 at the end of 2006. Goldman Sachs data tells the same story. Its preferred metric for net leverage -- the median ratio of net debt to operating income before depreciation -- stood at 1.71 in investment grade (IG) at the end of the first quarter, increasing from 1.55 in 2014. Net debt has grown 10.1% year-over-year while earnings remain flat. The market is seeing record investment-grade supply. Leverage is cheap (lower debt yield than equity yield), making debt-funded merger and acquisitions (M&A), dividends, and share buybacks attractive.

Another interesting topic related to the credit cycle is the correlation between maturity wall and default rate. Only 15% of outstanding high yield debt will mature in the next three years. People tend to use this as a reason to forecast low default rates in the next few years. However, recent GMO research shows there is little correlation between maturity wall and default rate. Actually, the last two high-default periods happened when the maturity wall was 2 or 3 years away.

Key Takeaways: Leverage for non-financial firms is weakening as debt issuance has outpaced EBITDA growth. The leverage for financial firms has improved during the same period because of regulatory requirements. In addition, the predicting power of maturity wall is not as strong as people thought.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.