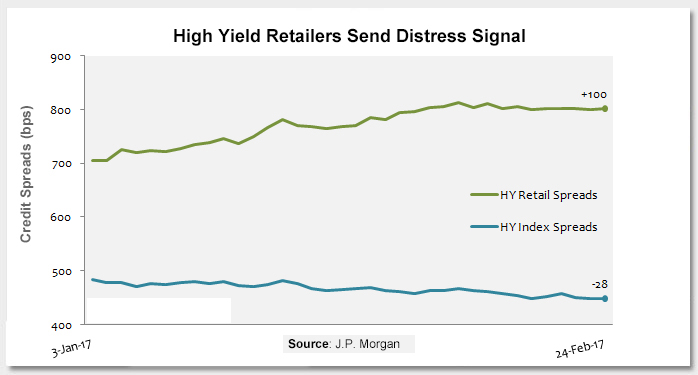

The high yield market continues to be a strong relative and absolute performer, up about 2.5% year-to-date (YTD) following a greater than 18% total return in 2016. Virtually all sectors have generated positive excess returns this year, except one: retail. As this week’s chart shows, the J.P. Morgan U.S. High Yield Index has tightened 28 basis points (bps), while the retail sub-index has widened 100 bps YTD. Often it pays to be a contrarian and add to sectors that are out of favor and have materially underperformed. Energy is the most recent example of this strategy. However, the situation in retail is neither cyclical nor supply driven, and I have limited confidence that performance will mean revert.

Despite a relatively good economy where consumer confidence is high, unemployment is below 5%, and wages have been on a recent upward trend, the amount of distress in high yield retail is notable. Companies like J.C. Penney, Bon-Ton, Claire’s, Gymboree, HHGregg, Sears and Toys R Us have been troubled for a while. The pain has now spread to some of the historically better regarded retail brands, such as J. Crew and Neiman Marcus which have unsecured bonds trading below 60 cents, as well as non-distressed but struggling companies like the Gap and L Brands. Brand value has always been an anchor supporting more aggressive leverage profiles, but equity valuations among retailers has dropped into the 4-6x EBITDA (earnings before interest, taxes, depreciation and amortization) range, providing much slimmer cushion for error.

Competition from online shopping and low-cost operators like Wal-Mart have been part of the retail landscape for years. Still, it appears as though an inflection point has been reached where Amazon.com and others have permanently changed the retail landscape in terms of mall traffic. Top-tier Class A malls continue to thrive, but as we have seen from our commercial real estate backed security holdings that have retail exposure, tertiary malls are in trouble. While a number of high yield retailers generate free cash flow and don’t face imminent liquidity issues, the structural headwinds are accelerating and those with elevated leverage may be forced to restructure.

Key Takeaway:Because there are many different retail concepts (i.e. apparel, home improvement, consumer electronics, toys, warehouse clubs, dollar stores, office supplies, household supplies, jewelry, etc.) and different price points (budget vs. luxury), bond investors don’t have to make a broad call on the sector to participate; rather, they can pick and choose their spots. Despite numerous low dollar price and yield opportunities, and plenty of precedent for poor performers to be the next outperformers, my gut tells me that most are value traps. An important near-term catalyst, which is binary in nature, is the potential passage of a cross-border tax, a reprieve that would cause bonds to rally but shouldn’t obscure the fundamental challenges facing much of the group.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.