I recently attended the 25th Commercial Real Estate Finance Council (CREFC) annual conference that was attended by a record number of guests (1,801). CREFC is a trade association exclusively dedicated to the commercial real estate finance industry. Overall, the tone of the conference was largely positive. The commercial real estate market remains on solid footing with stable fundamentals, ample liquidity and low volatility. While risks surrounding negative retail headlines are largely priced in, I remain cautious on collateral quality and broader market sentiment.

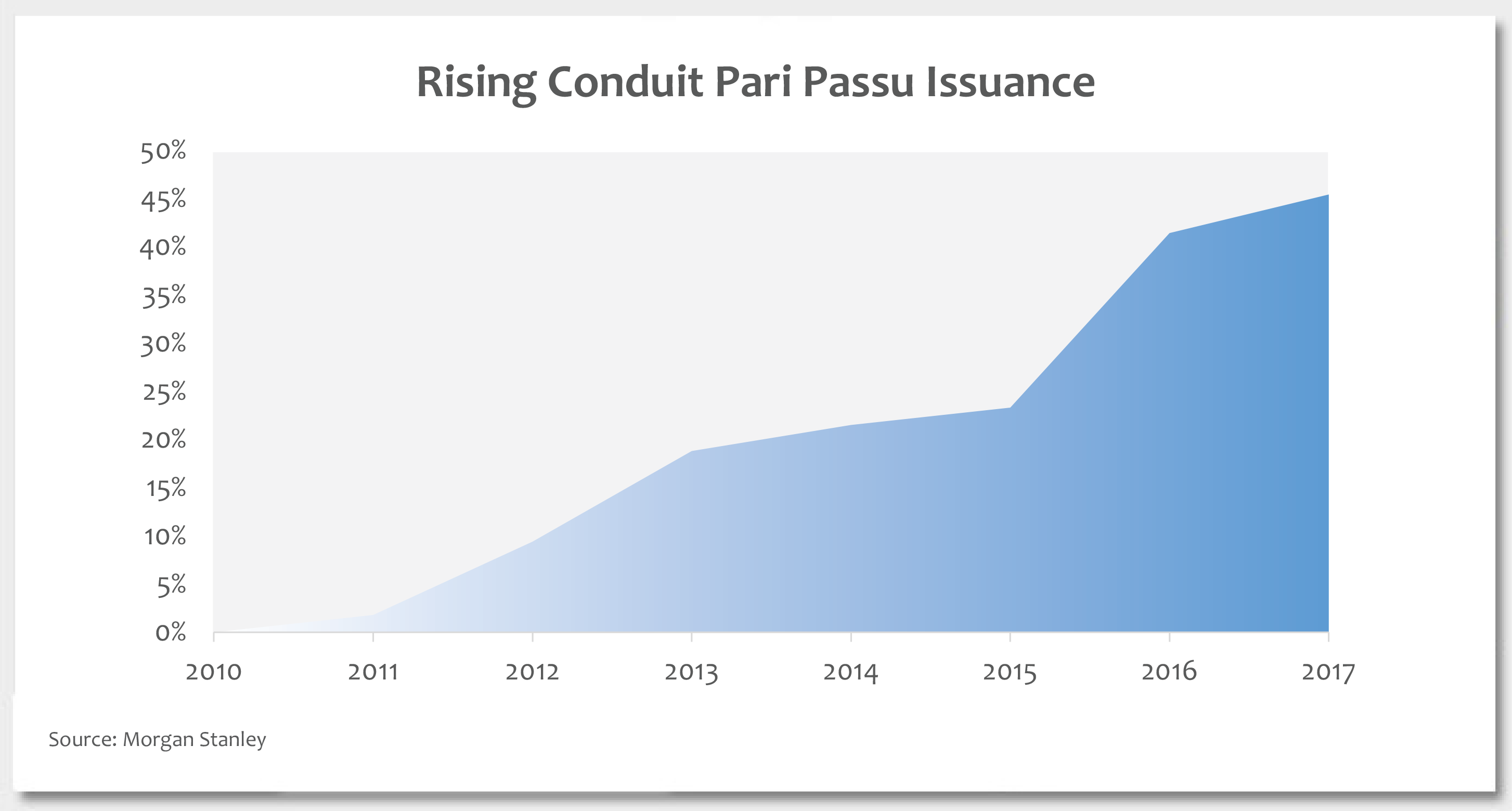

This week’s chart depicts the rising concentration of pari passu loans in commercial mortgage-backed securities (CMBS) conduit transactions. Large loans backed by trophy office buildings, hotels and premium retail malls are often split into smaller notes collateralizing two or more transactions on a pari passu, or equal-footing basis. This allows issuers more flexibility in creating pools to achieve diversification objectives. These large trophy properties often exhibit stronger credit metrics such as loan-to-value and debt service coverage ratios. The inclusion of pari passu can improve the overall deal credit metrics, however it often subsidizes weaker credits. This credit barbelling should be carefully reviewed to identify significant exposure to weaker loans. In addition, many large loans are interest-only for their term and are often encumbered with subordinate debt. This can increase default risk in the pool.

Conduit transactions issued in 2017 had an average of 45% exposure to split loans, up significantly from 9% in 2012. The rise of pari passu is partly due to the unintended consequence of regulation that increased the cost of funding, which has consolidated the conduit market and resulted in lower issuance and smaller deal sizes.

The rise of pari passu in CMBS transactions also increases concentration risks to large loans across investor portfolios. It is not unusual to see the same large loan across multiple transactions. Investors need to carefully monitor their exposure to properties split across several deals so they don’t make any unintended bets.

Key TakeawayInvestors in the CMBS market should be aware of potential risks with pari passu loans. Credit barbelling is not new in CMBS, however, risks are rising with the increasing presence of pari passu loans. Investors should evaluate the concentration risk in their portfolios to split loans and review any additional mezzanine or subordinate debt. I have had an up-in-quality bias as we move into the later stages of the current real estate cycle and remain cautious going down in credit given the current risk-reward opportunity.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.