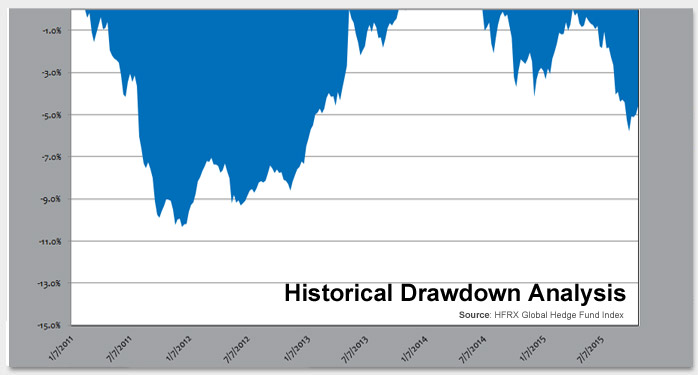

After another recent period of disappointing performance, hedge fund investors may be well served to heed a popular Yogi-ism: “Nobody goes there anymore, it’s too crowded.” This week’s chart displays a history of drawdowns (peak-to-trough declines) for the hedge fund universe since 2011. Crowded trades among hedge fund managers in increasingly illiquid markets have contributed to the recent losses.

The third quarter this year was especially challenging for equity long/short hedge funds as crowded equity positions fell sharply. Some of the most crowded stock holdings among hedge funds were Valeant (down 22%), Sun Edison (down 76%) and Micron Technology (down 20%).

Crowded behavior among hedge funds has not been limited to stock selection this year. An unexpected second quarter rally in the Euro versus the U.S. dollar caught many hedge funds “off-sides” in the currency markets. Last month, many hedge funds were caught on the wrong side of the rapid recovery in emerging market stocks and bonds. 2015 is shaping up as another year where hedge funds have failed to deliver performance that justifies the high fees investors are charged.

Key Takeaway: Despite some prominent hedge funds closing their doors this year (such as Bain Capital Absolute Return and Fortress Investment Macro Fund), industry assets under management continue to grow and recently set a record of over $3 trillion. However, the question now is if many hedge funds continue to simply follow the herd and deliver disappointing results, how much more patience will investors have to stick with the struggling asset class?

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.