This year, we have had the worst wildfires in California's history. One reason for the severity of these fires is the on-going drought and the especially hot summer weather. However, another and far more interesting reason is that we are just too good at fighting fires.

Wildfires are nature's way to clean the forest of diseases and insects. However, in the last few decades, with people living closer and closer to forests, people are fighting fires more actively and efficiently. The result of this active firefighting is a lot of dry bushes and trees that would have once been burnt in wildfires are left intact over the years. When these dry bushes and trees reach a level that is impossible for a firefighter to contain, we get the mega-fires that we see today.

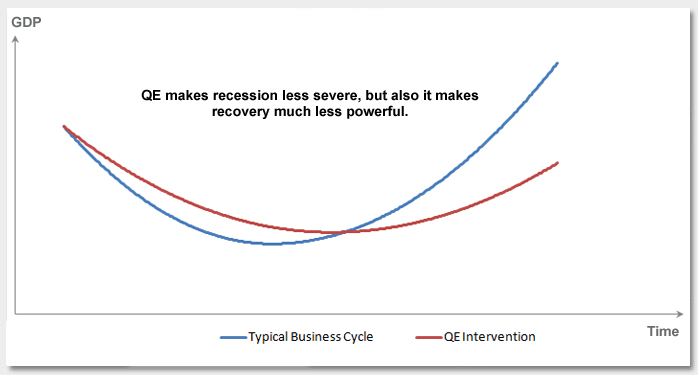

This phenomenon fits well with the anti-fragility framework described by Nassim Taleb, a Lebanese-American essayist, scholar, statistician, and risk analyst, whose work focuses on problems of randomness, probability, and uncertainty. It also makes me wonder about the full impact of Quantitative Easing (QE). We have all seen the benefit of QE when it was coming in: It reduces market volatility and makes holding financial assets much more pleasant and rewarding. What will happen to the market when QE starts to come out?

Recent market moves are not a vote of confidence. Volatilities in all markets are trading at very elevated levels; recent economic weakness from China makes the market even more treacherous. The Fed seems unsure as well -- telling the market for months that a hike is coming, only to end up not hiking rates on September 17.

Why is the Fed acting so cautiously?

My personal view is the Fed could once use economic data as a reliable gauge of the economy, but QE is making this more difficult. QE acts like the modern firefighting techniques. It extinguishes fires quickly and makes the system look healthy. But, does this mean the system is really safer, or do we still have a lot of hidden risk that can eventually lead to one mega-shock to the system?

Another interesting anecdote: Yellen always arrives at airport hours before her flight to avoid any possible surprise. This tells a lot about her personality.

Asymmetric risk/reward plus a cautious character led to no hike on September 17. Currently, the market is only pricing about a 40% probability of a hike before the end of the year, even though we have four Fed governors talking about rate hike before the end of the year. If I have to make a bet, I will bet with the market.

How do we trade this market?

There are four types of markets: quiet + trending; quiet + range-bound; volatile + trending; volatile + not trending. The most rewarding market is a quiet and trending market, which is what we had over the last five years. The regime is shifting to a volatile market, and asset return in general is not good during volatile markets. So, don't expect too high of a market return in the next few years. QE basically frontloads the asset return; the great returns we got in last few years mean a tighter risk premium and lower expected return down the road. There are times we try to go for the jugular and there are times we try to keep the money we made. Now it's time to focus more on capital preservation, which means a little less greed and a little more fear when we manage money.

One other interesting topic about QE is "people's QE," an idea from UK's labor party leader, Jeremy Corbyn. His theory is: The quantitative easing we did was to print money and buy bonds, which benefited the rich who hold financial assets. What we should do is print money and do infrastructure spending, which benefits wage earners and provides us with much needed infrastructure. This idea was borrowed from Richard Koo, the chief economist of Nomura. He has been a big proponent of using printed money for fiscal spending instead of quantitative easing. There is merit to this idea; however, politicians tend to overdo things. If we overdo "QE for the people," inflation will eventually come back. I don't see this happen any time soon.

Key Takeaways: During the financial crisis, famed investor Jim Rogers made this comment about QE: "Give me a trillion dollars, I will show you a good time." The last few years have been fun and rewarding for asset holders, but the next few years will probably not be so. During volatile markets, capital preservation is much more important than return maximization.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.