It seems like everyone these days, myself included, is looking to buy quality goods at bargain prices, which has been made easier by innovations in mobile computing. However, when I look at the equity market, which is sitting at its first record high for 2015, I find it challenging to find bargains.

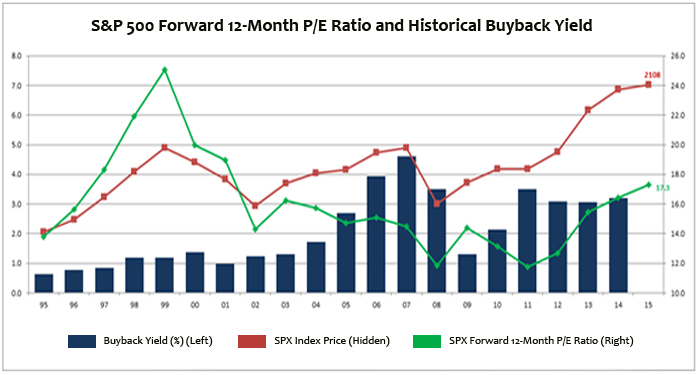

To put current valuation in perspective, this week's chart shows the 12-month forward price-to-earnings (P/E) ratio for the S&P 500 Index, which is currently sitting at a 17.3 P/E. The only period where it stayed higher than the current 17.3 P/E valuation for a long duration is during the Dot-com era between 1997 and 2002, and we all know how that ended. If you look at the share buyback history, you can see current share buybacks are at historically high levels. The chart also shows in the past, buybacks have not necessarily been well-timed.

Both indicators cause some concern for current equity valuation. However, this doesn't mean we sell everything and go to cash.

When we look at past business cycles, they usually end when the economic boom overheats and generates inflation (this is why it is not always a good sign when the energy and materials sectors start to rally). The Federal Reserve (Fed) will then have to tighten, and this will eventually end the boom. This time, what differs is that we had a boom on Wall Street, yet there has been little boom for Main Street. With stagnant wages on Main Street and little inflation pressure, the Fed has incentive to keep supporting the expansion.

This analysis gives me an investment hypothesis: There will be no doom on Wall Street until we see boom on Main Street. A lot of recent developments are good for Main Street (lower oil prices, stronger wage growth seen in January, Wal-Mart raising wages, strong dollar, high consumer confidence, etc.). We are watching closely to see how this affects the Fed's thinking and financial markets.

Lastly, this low rate, low dispersion, low volatility and low risk premium environment has been challenging for many market participants. It is important to be patient and keep a long term perspective in this environment. One book I recently read that talks thoughtfully about the patience and the long-term is "The Education of a Value Investor" by Guy Spier. It is fun to read and there is plenty of wisdom about life and investment in it.

Key Takeaways: Current equity market valuation is rich, but it doesn't mean the bear market is coming. For long-term investors, it is prudent to keep some money in cash, even though cash has been made very painful to hold. We are closely watching how the Fed reacts to recent strength in the labor market.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.