Many investors are struggling to find attractive investment opportunities in today’s environment. One can choose from waiting on the sidelines in cash, investing in government bonds (10-year U.S. Treasuries 2.3%), investment grade bonds (+105 basis points (bps) in the U.S.), high yield bonds (+439 bps in the U.S.) or equities (S&P 500 Index is up ~10% year-to-date) and other more esoteric and less liquid investments such as private equity, venture capital and real estate. Central bankers around the world have been using their balance sheets to buy the most liquid and least risky investments, and as a result, bringing the yields down significantly. Because of this, investors have been moving further down the risk spectrum in hopes of attaining the same returns they once were able to achieve. The central bankers’ actions have left other investors to fight for the remaining investable assets.

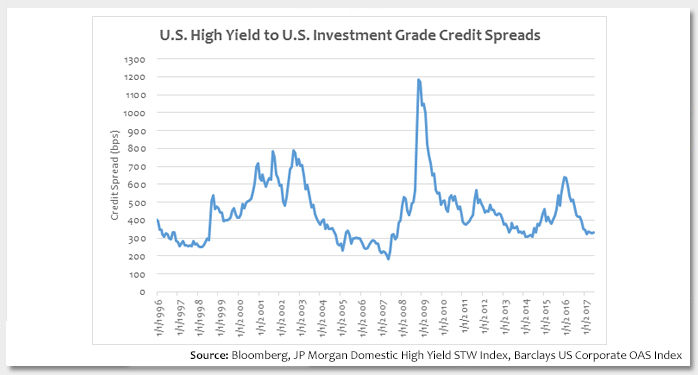

What is an investor with a specific investing mandate supposed to do? Institutional money managers are constantly reinvesting that money as cash comes in from new and existing clients, returns of prior investments and current income. The problem is current yields and expected returns are lower than where they’ve been historically. In order to reinvest and achieve similar yields and returns as prior investing periods, investors appear to be moving down the risk spectrum. As seen in this week’s chart, investors have been reaching for yield by buying U.S. High Yield and pushing spreads relative to U.S. Investment Grade corporates down towards historical tights. Investors appear to be throwing caution to the wind as they are forced buyers in markets with limited options.

Key Takeaway:Credit spreads, a measure of corporate credit risk, have been moving tighter as more capital chases fewer investment opportunities and not necessarily from less corporate credit risk. Investors need to be very selective in their credit investments to make sure they are being fairly compensated for the underlying credit risk. We are constantly analyzing risks and returns on a security-by-security basis. Today, we are finding better value in higher quality U.S. High Yield credits relative to the lower quality high yield credits, and we have been finding success in this part of the market.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.