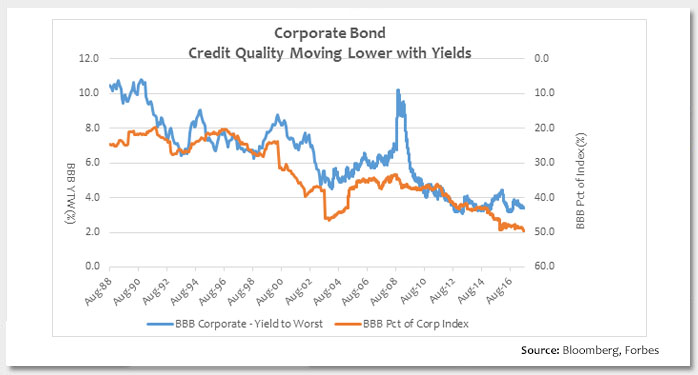

This week’s chart highlights the dramatic shift in credit quality for the corporate bond market during the past 30 years. Investment grade rated corporations have been on a 30-year borrowing binge judging by the increasing weight of BBB-rated credits in the Bloomberg Barclays Corporate Index. U.S. companies are taking advantage of lower and lower borrowing costs and embracing the use of higher leverage. Nearly half of the index is made up of BBB credits today ─ double the level from 30 years ago. Despite more than 60 companies being rated AAA in the 1980s, only Johnson & Johnson and Microsoft remain as the two U.S. companies with the top rating.

The most troubling aspect of increased leverage for corporate bond investors has been more companies using borrowed money for financial engineering (share buybacks, dividend hikes and M&A activity) as opposed to new investment since the financial crisis. The House Republican tax plan is trying to reverse this trend by shifting incentives toward business investment as opposed to financial engineering. Bank of America estimates eliminating deductibility of corporate interest expense for new debt issuance and immediate expensing of certain capital expenditures such as plant and equipment could shrink the corporate bond market by nearly a third. Declining trends in overall corporate credit quality are also likely to be reversed.

Key Takeaway:In the 1980s, Michael Milken, the Junk Bond King, warned investors that AAA-rated bonds have “nowhere to go but down.” In response to easy money central bank policies across the globe and record low borrowing costs, many corporations are finding the optimal mix of debt and equity puts them in the BBB-rating category. With interest rates and spreads near record low levels, in-depth credit research and discipline are even more important for active fixed income investors in today’s corporate bond market.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.