Since the initial pop in Lending Club’s initial public offering (IPO) in December 2014 (NYSE: LC), it has been a rather disappointing ride for investors. The resignation of Lending Club’s CEO this past Monday is likely to keep pressure on the stock in the short term. As though the scandal associated with the CEO’s departure weren’t enough, the U.S. Treasury Department on Tuesday called for increased regulation in the industry. How could an industry darling such as Lending Club, which at one point garnered so much excitement regarding its growth prospects, land itself in such a predicament? Unfortunately, Lending Club’s troubles are a microcosm of the potential pitfalls that await the many banks, investors, and servicers that have rushed into the consumer lending space.

Servicers that have entered the space are looking to fill the credit gap left by the banks, as banks have pulled back from unsecured consumer lending since the financial market crisis. This business model of providing credit to the ‘underbanked’ has been welcomed by consumers and investors alike. Investors have benefitted from the attractive yields, and many have looked to securitization as both a complement to holding the loans and also as an exit strategy out of the trade, depending on the investors’ business models. However, the sector has hit some bumps in the road over the past few years, as rating agencies struggle with how to model the sector, government regulatory authorities (e.g., the Consumer Financial Protection Bureau) weigh the needs for additional regulation and investors seek to understand new risks in the sector (e.g., consumer fraud in the peer-to-peer framework).

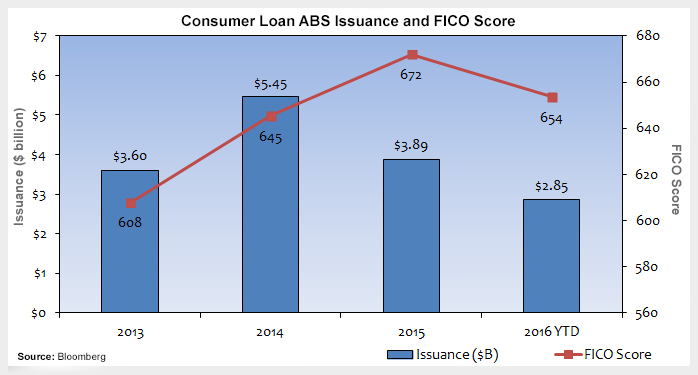

This week’s chart shows that rated issuance continues to be low in the consumer loan asset backed securities (ABS) sector, and, while some near-prime deals have printed, on average the borrower credit quality is subprime. Consumer loan ABS continues to offer attractive spreads and has not participated in the recent rally in structured products to the extent of most structured sectors. However, the sector is cheap for a number of reasons that warrant the attention and caution of investors brave enough to enter the space.

Key Takeaway: The consumer loan ABS sector houses numerous business models, including business-to-business (B2B), business-to-consumer (B2C), and peer-to-peer (P2P). Each of these business models comes with its own set of risks and opportunities. However, these business models, when taken together, share some common obstacles: Low issuance, low liquidity, increasing regulation, weaker borrower credit quality and the unforeseen risks associated with a relatively new space. Until some of these obstacles are mitigated, investors can expect to see continued volatility in the sector.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.