Before bitcoin grabbed all of the headlines this November, a widely talked about trade in 2017 had been the short-volatility trade. One popular trade investors have used to monetize the low volatility environment, XIV, has gained almost 200% this year. Although these returns don’t stack up with bitcoin’s run in 2017, the fundamentals driving short-volatility strategies are much clearer. But before discussing why the past year has been supportive of short-volatility strategies, I want to discuss two types of strategies first.

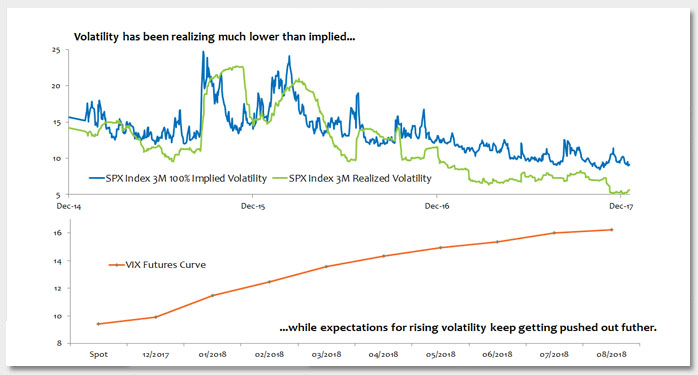

One strategy is to sell an option and delta hedge. This strategy hopes to monetize the difference between implied volatility and realized volatility. Another way to think of this is to imagine implied volatility is the price at which you sold the optionality to the buyer, and realized volatility is your cost from buying and selling the underlying asset to offset the exposure you have to the asset’s price from selling the option. If implied volatility (the price you sold optionality) is consistently higher than realized volatility (the cost of providing the optionality), the trade will perform well. As you can see in this week’s chart, realized volatility has been much lower than implied volatility throughout 2017.

A second strategy is to short the VIX via futures. The VIX is a measure of the market’s current estimate of future short-term (under three months) volatility based on a weighted average of the implied volatilities on near-term S&P 500 options. VIX futures, then, measure the market’s future (at the settlement date) expectation for future short-term volatility. This week’s chart also shows expectations for rising volatility continue to get pushed out further. The VIX futures curve has spent the majority of the year in contango – a state where the VIX futures price curve is upward sloping and higher than the current VIX level. When you sell a VIX future with the curve in contango, it will “roll down” the futures curve and you can buy it back or let it settle in the future at a price lower than the price you sold it. This trade performs better the steeper the VIX futures curve is because the roll down is larger.

The low-volatility environment in 2017 has been talked about hand-in-hand with the current “Goldilocks” economy that is neither “too hot” nor “too cold.” Stable levels of global growth and inflation have lowered the uncertainty surrounding central banks’ actions as they begin to slowly and gradually tighten monetary policy. The perceived likelihood of a hard landing in China as it rebalances its economy has fallen as well. Additionally, political uncertainty this year has been much more muted compared to 2016, when Brexit and the U.S. election increased market volatility. The reduction in uncertainties has allowed a risk-on tone to persist all year and kept realized volatility low and pushed expectations for increased volatility out further in time. Within equities, inter-sector correlations have fallen sharply due to sector rotations such as “cyclical versus defensive” and “growth/tech versus value/financial/energy.” Correlations and volatility tend to increase during risk-off periods.

Key TakeawayA very benign economic and political backdrop in 2017 has allowed short-volatility strategies to perform well this year. Some opponents to the strategy have characterized it as a crowded trade that will unwind sharply and painfully. However, the relative spread between implied and realized volatility is at near-term highs and the VIX futures curve remains in steep contango. For now, the economic and political backdrop will continue to support short-volatility strategies. I will be keeping an eye on changes to this backdrop in 2018 that would affect my outlook for this trade.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.