Investors and policy makers alike have been paying close attention to the shrinking Treasury term spread, defined by the difference between long-term and short-term interest rates. Recently published economic research from the Federal Reserve Bank of San Francisco helps explain why. Their report, titled, “Economic Forecasts with the Yield Curve,” highlights how an inverted yield curve or negative term spread has shown remarkable accuracy in forecasting slowdowns in economic growth. A negative term spread or inverted yield curve “has correctly signaled all nine recessions since 1955 and had only one false positive in the mid-1960s” for the U.S. economy[1].

The recent flattening of the yield curve is, at a minimum, “flashing orange” for the U.S. economic outlook. However, another widely followed indicator in the bond market is telling a different story. Breakeven inflation expectations – the spread between nominal Treasury bonds and Treasury Inflation Protected securities (TIPs) – have been steadily moving higher, even as the yield curve flattens. In theory, higher inflation expectations should lead to a steeper yield curve as investors demand higher compensation to invest in riskier long-term bonds[2].

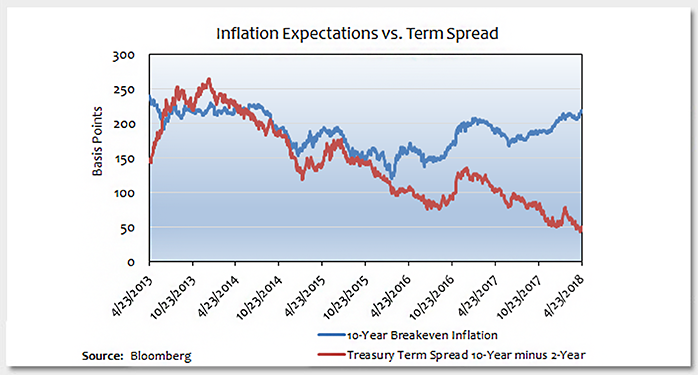

This week’s chart shows a 5-year history of the Treasury term spread curve and 10-year market implied breakeven inflation. The two spreads were highly correlated (both pricing in lower inflation) until the Federal Reserve began hiking interest rates in December 2015. Since then, their diverging paths have continued sending mixed signals about the risks of mounting inflationary pressures in the United States.

Key Takeaway

Successful fixed income investors must constantly understand and analyze the interplay of numerous signals in the bond market, including breakeven inflation expectations and the term spread. I view the mixed signals coming from these two indicators a function of unprecedented monetary policy accommodation still prevalent in Europe and Japan. The Treasury yield curve will normally flatten as the Fed tightens, but long-term Treasury yields have barely budged since the Fed’s initial hike in 2015, despite increasing signs the Fed will soon meet its 2% inflation target. The gravitational pull from low or negative rates in Europe and Japan will keep the U.S. yield curve flat until interest rates begin to normalize overseas.

[1] Federal Reserve Bank of San Francisco

[2] The Liquidity Preference and Expectations term structure theories

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.