Bitcoin is a hot topic in the financial media right now. At post time, one bitcoin is worth approximately $11,750, up from roughly $1,000 at the beginning of 2017.

We also see the craze for bitcoin in the stock market. For instance, shares of Overstock.com (OSTK), a small e-commerce company, spiked in price after announcing they have a venture that works on cryptocurrency related applications. Riot Blockchain, Inc. (RIOT), formerly a small biotech company, recently refocused their research from animal fertility to blockchain technology, driving their stock price from $8 per share to $23 per share in a week.

Over the weekend, we heard the news that Bill Miller turned $2 million in bitcoin into $75 million, and the Winklevoss twins became billionaires from their investment in bitcoin.

This all reminds me of the “dot com” era. I will be very cautious with bitcoin at this point. Some believe it can go up another $10,000 to $20,000, but I still believe it is more a game of greater fool than a viable investment.

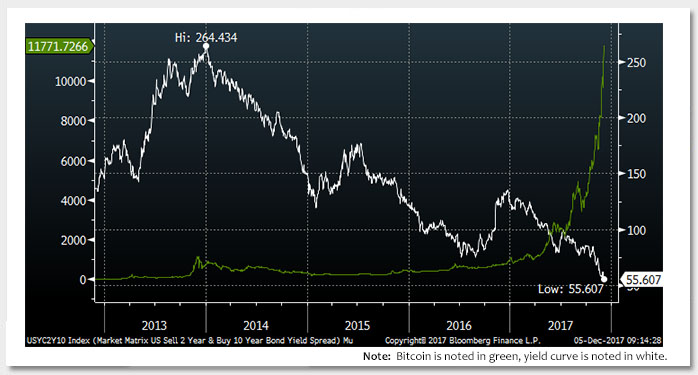

While bitcoin prices have generally risen each day, the Treasury curve simultaneously flattens. When we look at this week’s chart, the yield spread between two-year and 10-year Treasury is at roughly 56 basis points (bps), the lowest point in the last 10 years.

There are two main drivers for the flattening yield curves:

- The U.S. Treasury indicated they will mainly use two-year Treasuries to fund the increasing funding needs next year. This increased supply of front-end Treasuries drove up their yields.

- The corporate tax rate will likely come down next year. Because pension contributions are tax deductible, the tax deduction is worth more now than when the tax rate declines. As a result, corporations want to contribute to their pension plan before the end of the year. These contributions into the pension plan are mostly used to purchase long-term bonds to immunize the pension liability. This increased demand for long-term bonds drove down the yield for long-end Treasuries.

The flattening of the yield curve has happened quickly, just like the bitcoin rally. However, while I won’t buy bitcoin, I don’t think the flattening yield curve will fade away.

The front-end rates trade with the Federal Reserve (Fed) rate hike expectation and economic growth in the next 12 to 18 months. At this point, the economy is looking good. With tax reform moving ahead, we are getting a tax cut in a robust economy. There is not much slack in the economy at this point and the Fed will have to hike rates more next year. These factors will likely increase front-end yields. The long-end rates trade with the long-term potential for economic growth and inflation, which hasn’t changed much. When the Fed keeps hiking rates in the next year, the yield curve can stay flat or even inverted after a few more hikes.

Key Takeaway:The bitcoin rally is unlikely to be sustainable. The flat yield curve is not a sign of recession risk; it is more driven by supply and demand dynamics at the moment. Longer term, the yield curve is likely to stay flat, when we have a positive cyclical outlook with structural headwinds from demographic, technology and financial leverage.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.