The European stock market has been a popular topic and investment in 2015. Since the European Central Bank (ECB) launched "Quantitative Easing" in January, major European stock indices are up about 20% year-to-date. In 2015, $54 billion has flowed into European equities, with $64 billion flowing out of U.S. equities. Money chases the most aggressive central bank.

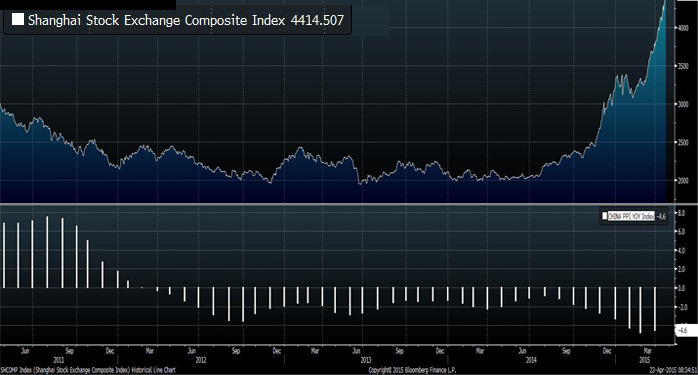

There is much more negative talk about China's economic slowdown and the risk of a real estate bubble. The latest Gross Domestic Product (GDP) from China is 7%, the weakest level since 2008; what's more, the year-over-year Producer Price Index (PPI) is currently at -4.6%, indicating significant deflation pressure in the pipeline. However, even with all these negativities, China's Shanghai index is up 32% year-to-date, and up 108% in the last year, making it easily the best performing equity index in the world.

What is driving this rally? Mainly, three drivers:

- The market is expecting monetary easing. This week's reserve requirement ratio (RRR) cut is just one of them; there will be more. Monetary easing has been a driving force in this post-crisis bull market, and there is no difference here.

- Confidence about the reform and a new growth model. In the previous bull market, the leading sectors were real estate, metal & mining, and banks -- drivers of the old Fixed-Asset-Investment-Driven growth model. This time around, the best performing sectors are information technology, health care and capital goods. These represent the direction of a new growth engine, and they are more value-added and more-consumption driven.

- Just as in every bull market, there is a component of speculation. In this rally, low dollar-priced stocks have outperformed. This is a typical sign of heavy participation of individual investors. The record margin debts, and the education level of new investors (2/3 of new trading account holders have below a high school degree), are all signs of speculation.

One last thing worth mentioning is the development of Asian Infrastructure Investment Bank and Silk Road Infrastructure Fund. These two are talked about more as a political topic than an economic topic. Together, the two of them have $90 billion to $140 billion in capital -- half of the World Bank's capital ($223 billion). Where and how the capital is deployed bears close watching.

Because there are fundamental reasons behind the rally, we will not fade it just because there are signs of speculation. For those who want to know more about the reforms in China and the challenges and opportunities they represent, I highly recommend the Bridgewater Daily Observations from 4/14/2015. Incredible breadth, depth and excellent analysis!

As the second largest economy in the world, the trajectory of China's growth has deep implication for financial markets and the global economy. If China avoids the "hard landing" that many feared, metal & mining sectors will benefit, and global deflation fears will recede. Other Emerging Markets would also benefit.

Currently, Emerging Markets (China has 20% weight in EM index) and metal & mining are probably two of the least favored sectors. I had been avoiding these two sectors until late last year; now, I think these two sectors have become interesting as a contrarian/value play. The risk here is stronger U.S. economic data, which could lead to a much stronger dollar. From a portfolio construction point of view, I view these two sectors most attractive to a portfolio that already has a long dollar position and little EM/metal & mining exposure.

Key Takeaways: Pessimism is high around China's growth prospects, and rightly so. There is a speculative fervor in the Shanghai stock market. I see the downside risk for China's growth, but I also recognize the government is implementing the reforms the economy needs. The valuation and risk/reward makes Emerging Markets and metal & mining an interesting play to position for the possible policy success. Again, this especially fits a portfolio that is already long dollar.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.