The DXY Index is the benchmark for the U.S. Dollar and since last June, it has rallied more than 20%. Recently, it broke through 100 for the first time since April 2003. U.S. economic performance and the change in monetary policy are the two main drivers for the strong dollar.

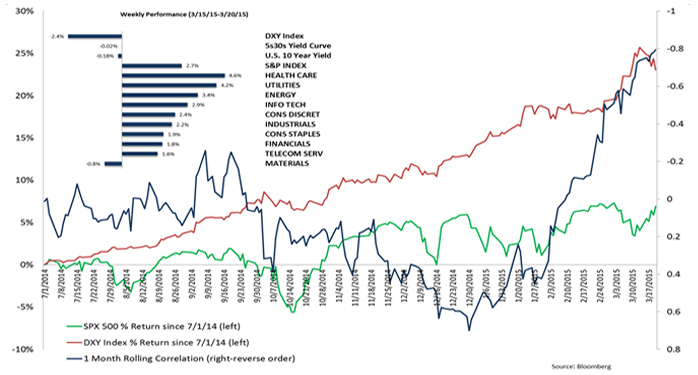

However, even though fundamentals support the strong dollar, there is a level where the strong dollar becomes a drag for the U.S. economy and corporate earnings. Since January 2015, we have seen a negative correlation between the dollar and the equity markets. The correlation has reached -80% recently, as demonstrated by the dark blue line in the chart. This is an indication that dollar strength is weighing on corporate earnings and domestic economic growth, a third of S&P 500 sales and 40% of its profits are from overseas.

Last week, after the Fed mentioned the weakness in export sectors, the dollar corrected sharply. The dollar was down 2.4% for the week, while the S&P 500 was up 2.7%. The market recognizes that the Fed is monitoring the impact of the dollar on the economy and will delay the rate hike if the economy is not strong enough. At this moment, any delay of a rate hike is considered good news for the equity market. Since weak economic data delays rate hikes, we are now again in the regime of "good news is bad for risk assets, and bad news is good news."

Additionally, when looking at the sector performance, we saw healthcare and utilities were up strongly last week, while financials and consumer discretionary underperformed. This is another signal that the market is dialing down the growth expectation, which is consistent to the rally of treasuries and weakening of dollar.

Going forward, we don't think the Federal Open Market Committee meeting will derail the dollar bull market, even though we recognize that the Fed wants to see more momentum in the economy before a rate hike. This means we will likely see the dollar consolidate and retrace some of the recent rally in the next few months; however a very crowded dollar long position can exacerbate this reversal.

Recent economic data has been disappointing in the U.S. If this is truly because of the cold winter and west coast port strikes -- a big "if" -- we can expect to see some improvement in the coming months. Improving economic data should reignite the dollar bull market.

The first quarter earnings season is approaching quickly, and we are looking for signs of how the recent dollar strength affects corporate earnings. This should give us some clues as to how the equity market performs in a dollar bull market. We also want to see more confirmation of our view of "Main Street outperforms Wall Street." Recent news of T.J. Maxx and Target raising wages is a very encouraging sign.

Key Takeaways: The strength of the dollar is currently viewed as a negative for the equity market. The dollar rally is going to take a pause to allow the economy to catch up with market pricing. If the economy does improve with the end of winter, more strengthening of the dollar should be expected. If this strong dollar environment continues, small cap stocks should outperform large cap stocks, which is a reversal of last year.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.