The lifecycle of a collateralized loan obligation (CLO) is typically characterized by an initial warehouse/ramp-up period, during which the CLO manager purchases collateral to back the CLO. This is followed by the reinvestment period, during which the CLO manager actively trades the portfolio based on a particular strategy. The reinvestment period is then followed by the amortization period, during which time the proceeds from sales or paydowns are used to amortize the CLO debt tranches and wind down the deal. The length of the reinvestment period is sometimes used by investors as a proxy for the length of the deal in general, with an adjustment for where in the capital stack the investor is located. CLO debt investors used to complain about reinvestment periods getting longer. For post-crisis deals, it was common for the reinvestment period to be four years long. Then, five-year reinvestment periods became the “new normal,” and managers that could get away with it would opt for the longer reinvestment period, thus locking up management fees and AUM for a longer period of time. The industry was aware that extending the reinvestment period was a positive for CLO managers and equity holders, but a negative for debtholders. What could debt investors do to counter this sea change in the industry?

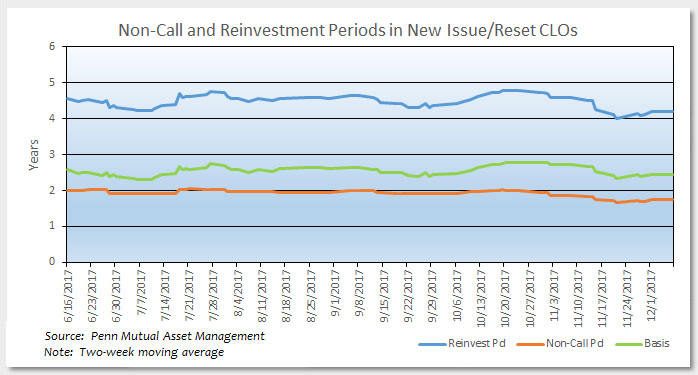

However, starting in November of this year, debt investors started seeing more deals getting done with much shorter reinvestment periods. Deals were still getting done with five- or four-year reinvestment periods, but then investors also started seeing deals with reinvestment periods as short as three years, and in some cases, even as short as two years. My initial reaction was to think that perhaps some large debt investors had finally gotten the message across that they wanted shorter paper. However, some discussions with CLO bankers and equity holders at the recent Opal conference changed my view on this.

The current credit cycle is inarguably long in the tooth, but the economy continues to exhibit some material tailwinds that suggest this credit cycle could continue to extend even further before it turns. However, underlying leverage embedded in the companies packaged into CLOs continues to creep up, suggesting that it is only a matter of time before the cycle does turn. Some CLO managers and equity investors are thinking they can squeeze out perhaps one more year of healthy performance before credit cycle concerns become magnified again. This would lead CLO structurers to favor a non-call period of 0.5 to 1.5 years, rather than the traditional two years. However, debt investors would not be willing to take a shorter non-call period without a similar reduction in the reinvestment period. So, in a sense, this new type of non-call/reinvestment period structure would seem to be a win-win: debtholders get shorter paper, and equity holders/CLO managers get the optionality of kicking the can down the road for another year, and then refinancing or resetting their deals one more time before the credit cycle turns. If the credit cycle seems like it can bear it, then maybe CLO managers would reset the deal for another year at that point. Otherwise, if it looks like the credit cycle will turn sooner rather than later, then CLO managers and equity holders can do a traditional five-year reinvestment period deal at that point and lock up some AUM for the long haul, thus hunkering down for the bumpy ride that would ensue once volatility finally appears again.

As the end of the credit cycle nears and spreads continue to tighten, I favor higher-quality loan pools with stronger managers and continue to see attractive risk-adjusted returns further up the capital stack. I believe this approach will provide protection against spread volatility. There is a strong momentum trade that is underway, and some market participants believe there is a basis compression story that will continue to play out in mezzanine CLO debt. However, there will be better entry points for mezzanine CLO once volatility returns, and I would favor that approach over a momentum trade toward the end of a credit cycle.

Key Takeaway:

Some deals with shorter reinvestment periods have been issued over the past month, even with stronger CLO managers that would have no problem doing a five-year reinvestment period deal. Debt investors like the shorter paper, and CLO managers and equity holders like the optionality of being able to refinance/reset the deal again in a shorter period of time. An added side benefit is that managers can execute at tighter levels for shorter deals. However, the optionality that CLO managers and equity holders are seeking could also serve as a warning to investors that they should continue to think about how to prepare their portfolios for when the credit cycle finally does turn.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.