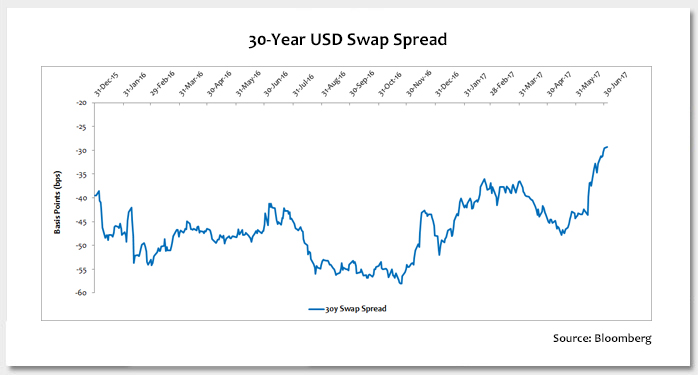

Second quarter U.S. dollar (USD) interest rate markets were very unexciting when looking at absolute movements in both swap rates and Treasury yields. However, an interesting development arose concerning the relative movement between the 30-year points of these two curves that will likely have the attention of market participants through the end of the year. The 30-year swap spread – defined as the difference between the 30-year swap rate and 30-year Treasury yield – has widened (or become less negative) significantly since June 13th, when the Treasury released its recommendations for financial industry reform, including a proposal to remove U.S. Treasuries (USTs) from the denominator of the supplementary leverage ratio (SLR) calculation. This proposal would effectively make USTs “cheaper” for banks to hold from a capital requirement perspective.

The 30-year swap spread was -43 basis points (bps) the day before the Treasury’s announcement, meaning the fixed rate on a 30-year interest rate swap was 0.43% lower than the yield on the 30-year Treasury bond. At present, the 30-year swap spread is -29 bps. Another way of thinking about this is that 30-year Treasury yields have fallen 0.14% relative to 30-year swaps over the past three weeks. This move suggests the market believes to some extent that this proposal will be adopted. By making USTs less capital-intensive for banks to hold, demand for USTs should increase and consequently should increase prices and lower yields (bond prices and yields move inversely). In the past few weeks, there has been a lot of buying in 30-year spreads (receiving the UST yield and paying the swap rate) by market participants in hopes that this move continues wider. Researchers also have been busy trying to calculate where the 30-year swap spread could theoretically stabilize if the proposal is adopted based on banks’ new expected return on equity (ROE) for a long 30-year swap spread position that is financed with general collateral (GC) and LIBOR funding.

Key TakeawayThe fact that the Treasury made the recommendation to remove USTs from the SLR denominator increases the likelihood of its adoption. However, the timing of its implementation and the size of the move already in the 30-year spread may make those entering a long spread position less confident now than they were three weeks ago. For those with a longer time horizon, a financed long position still has positive carry, even after considering the cost of initial margin and any funding haircut.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.