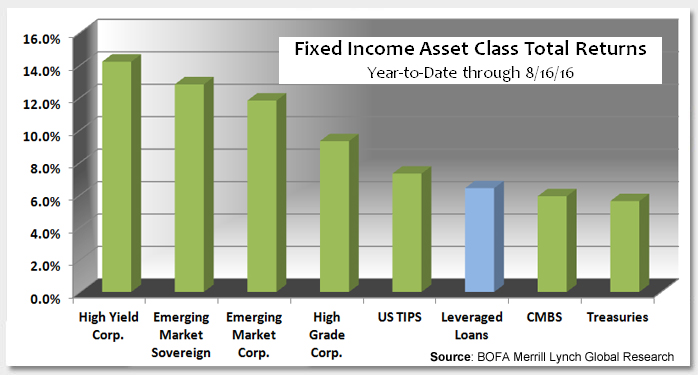

Fixed income total and excess returns continue to impress, and 2016 is on pace to collectively be one of the stronger years for spread product in the post-crisis period. As seen in this week’s chart, an asset class that has performed well, but has lagged on a relative basis, is leveraged loans. Given current valuations in the financial market, low absolute yields and compressed spreads, as well as our somewhat defensive macroeconomic outlook, I think the risk/reward profile looks attractive for loans.

Some aspects of leveraged loans, both positive and negative, include:

- They are issued by non investment-grade companies.

- They are floating rate, typically based on 3-month LIBOR, and most have LIBOR floors of 75-100 basis points.

- They are senior in the capital structure in terms of repayment in the event of default.

- They are secured by the assets of the company.

- Protective covenants are currently limited.

- Price appreciation is limited, given the ability of the issuer to call the loan at par, usually after a short window of protection that requires a $101 take-out.

- They have much less energy exposure versus the unsecured corporate bond market.

- Over half of the buyers in the loan market are collateralized loan obligations (CLOs).

These features have different implications for the relative attractiveness of loans versus high yield bonds and other risk asset classes, depending on your view of the direction of spreads and rates. Liquidity is also an important factor to take into consideration before purchase.

With the rally in spreads across corporate and structured credit, finding value in the market has become much more challenging. Currently, leveraged loans look like a reasonable choice, particularly versus high yield credit, given the tremendous outperformance of the latter and spread compression within the capital structure. Loans will benefit from rising LIBOR rates if macroeconomic data leads the Federal Reserve (Fed) to raise rates. They also have attractive carry, more limited price volatility, and decent liquidity. Coincidentally, 3-month LIBOR has risen over 20 basis points in the last two months, pushing the rate over the 75 basis point floor in many loans. This is largely attributable to money market reforms being enacted this year (see earlier Chart of the Week).

While the technical tailwind from the money market reforms may diminish, there could be a fundamental catalyst for rising LIBOR rates: Creeping inflation expectations. I have seen this head fake numerous times over the last few years, and I am not convinced the Fed will act this year in raising short-term rates, but the probability has increased recently.

Key Takeaway:I think leveraged loans offer a good relative value in the current environment, balancing yield, credit quality, duration and liquidity risk. Valuations also look more attractive due to their relative underperformance year-to-date, and I am looking to add to our leveraged loan holdings.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.