Despite correctly calling the long-running bull market to extend into “extra innings” last year, we did not foresee financial markets finishing 2017 with a perfect batting average. For the first time on record, both domestic and global equity markets posted 12 consecutive months of positive total returns. Will equity and credit market performance in 2018 continue to be driven by the powerful forces of positive momentum and the return of animal spirits, or will stretched valuations ultimately limit additional gains?

For fixed income investors in an asset class with limited upside return potential, the balance tilts heavily toward transitioning bond holdings shorter in duration and higher in credit quality. The cost of defensive positioning declined markedly last year – a result of the flattening yield curve and credit spreads grinding tighter. Fixed income credit and term risk premiums are now both at the lowest levels since the financial crisis.

We favor Treasury Inflation Protected securities (TIPs), which offer diversification benefits in addition to inexpensive protection against an uptick in inflation during later stages of this long-term economic expansion. Cyclical pressures for higher inflation are likely to finally win the day versus secular disinflationary forces, including technology, globalization and aging demographics. The emergence of blockchain technology and rapidly appreciating cryptocurrencies pose additional inflation risks, as increasing competition for the U.S. dollar and other fiat currencies will result in an eventual decline of purchasing power.

Positive momentum across equity markets appears nearly unstoppable heading into 2018, with corporate tax reform, an easier regulatory environment and building investor optimism conspiring to push markets into record territory. Equity valuations are elevated versus historical averages but nowhere near bubble territory, especially in light of today’s low interest rate environment. We are reserving the bubble label for today’s global bond market, with nearly $10 trillion of debt trading with negative interest rates. The return of synchronized global growth is simply inconsistent with unprecedented monetary policy accommodation, including negative interest rate policies in Europe and Japan. Central banks have so far successfully managed the balancing act between negative interest rate policies and the improving growth outlook, but risks are building. We expect the red-hot equity markets to cool down once either side of low inflation/synchronized growth outlook disappoints.

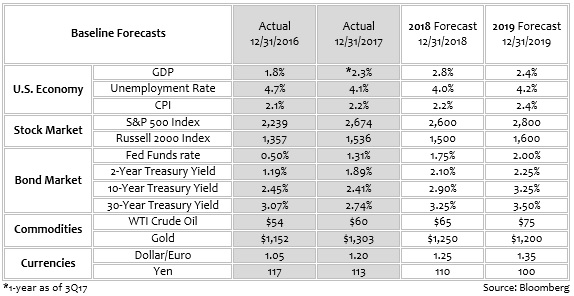

Exhibit 1: 2016 and 2017 Actuals and 2018 and 2019 Forecasts

To read our 2017 market and economic year-in-review, please click here. Check back to the blog weekly for more updates on our market outlook and investment ideas. Or simply click here to subscribe!

Index Definitions:S&P 500 Index – An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

Russell 2000 Index – An index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks.

All trademarks are the property of their respective owners.

Disclosures:The views expressed in this material are the views of PMAM through the year ending December 31, 2017, and are subject to change based on market and other conditions. This material contains certain views that may be deemed forward-looking statements. The inclusion of projections or forecasts should not be regarded as an indication that PMAM considers the forecasts to be reliable predictors of future events. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate. Actual results may differ significantly.

Past performance is not indicative of future results. The views expressed do not constitute investment advice and should not be construed as a recommendation to purchase or sell securities. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed. There is no representation or warranty as to the accuracy of the information and PMAM shall have no liability for decisions based upon such information.