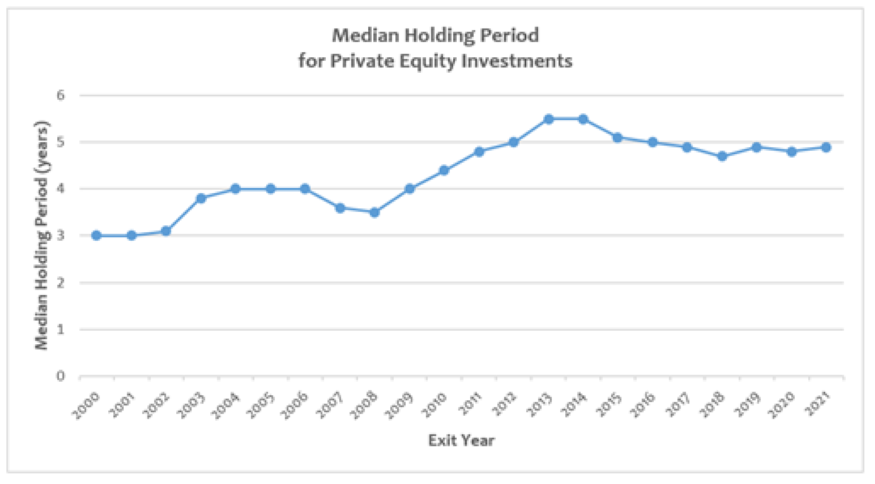

Private equity investments are traditionally long-term in nature with a typical holding period1 ranging between three and five years. During an investment’s holding period, General Partners (GPs) focus their attention on increasing the company’s value in order to sell it at a profit and distribute the proceeds to its Limited Partners (LPs). Deciding when to sell a portfolio company involves a myriad of factors, including the market’s receptivity to anything from mergers and acquisitions (M&A) in general to the specific industries or sectors in which they operate. When observing the median holding period beginning in 2000, the duration increased significantly and peaked at about five and a half years in 2013 as a result of the challenging exit environment coming out of the Global Financial Crisis (GFC). The median holding period stabilized in the years that followed, averaging about five years between 2015 and 2021.

Not reflected in the chart is the fact that the deal-making party (ex. M&A; IPO) stopped a few months into 2022. While some of this slowdown can be attributed to many GPs taking advantage of 2021’s surging deal activity and multiples by pulling exits forward, aggressive interest rate increases, slower growth, a closed IPO window and record inflation have played a significant role in slowing deal activity. In fact, according to S&P Global, overall 2022 exit activity fell by nearly one-third from the record $576.37 billion in 2021, totaling $391.44 billion for the year.2 This slowdown in deal activity has resulted in hold periods beginning to stretch out — a fact that has been supported in conversations that I’ve had with GPs.

In the current environment, many GPs have been unwilling to part with promising assets in less-than-favorable market conditions. While they selectively consider whether to sell companies on their original timeframe, many have determined that it makes sense to delay the exit of many of their portfolio companies until the exit environment improves. This mindset is likely a carryover from the GFC, where many GPs believe they let go of assets too quickly rather than doing what they could to hang on and ride out the storm. The private markets data source Preqin is projecting depressed exit activity over the next few years as slower global economic growth continues to hinder private equity performance.

These longer hold periods will test private equity firms' value-creation strategies, potentially rewarding skilled, active operators and revealing the fund managers who relied too heavily on financial engineering to increase returns. Further, it potentially creates new opportunities for investment at lower entry points, recognizing that the seeds of private equity’s best vintages are often planted during difficult times. Longer holding periods are, of course, a double-edged sword for LPs. While extending holding periods may protect returns over the longer term, the longer hold periods will also make it harder for LPs to fund new commitments from exit-driven liquidity.

Key Takeaway

LPs should expect to hold onto their private investments longer than they may have initially anticipated as the M&A environment has slowed considerably. Longer holding periods will likely allow LPs to easily differentiate between GPs that have historically utilized high levels of debt to win prized assets at inflated valuations and those that managed to remain disciplined around their leverage and pricing strategies. LPs, especially those who expect to fund new commitments from exit-driven liquidity, will need to be aware of their asset concentration and commitment strategies in order to make sure they can continue to manage their portfolios in line with long-term goals. If LPs are able to stay in the game, they stand to be in a position to benefit from what should be some strong future vintages.

Definition:

1Holding Period: The time frame in which private equity firms’ hold on to portfolio companies.

Source:

2S&P Global – Longer hold times put private equity strategies to the test; 1/9/2023

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.