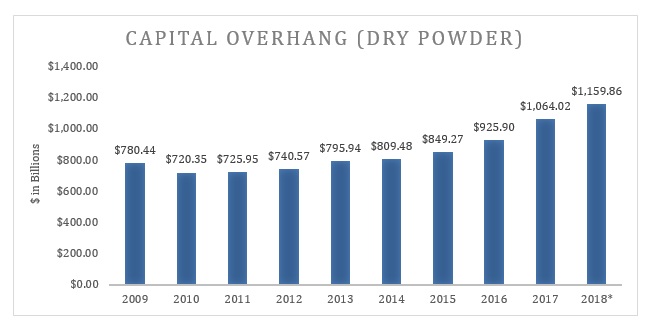

Institutional investors have been drawn to private equity over the last decade, driven by the hunt for growth, yield and diversification, as well as strong performance. The flows of capital into the asset class have almost doubled dry powder, or capital that has been committed to private equity funds but not yet invested, from $780 billion at the end of 2009 to $1.16 trillion as of June 2018.

The buildup of dry powder is concentrated in traditional buyout funds, venture capital and growth equity strategies. However, other private equity buckets, including direct secondaries and distressed funds, are also seeing their largest capital inflows in more than a decade. As a result, valuations have soared to record-highs and general partners (GPs) find themselves between a rock and a hard place, debating whether to invest at aggressive valuations or wait out the cycle. Currently, 79% of private equity investors believe asset valuations pose a threat to generating quality returns, according to a Preqin survey. These factors and fears of a near-term recession will weigh heavily on investment decision-making over the next few years.

While the current market environment presents challenges, I believe there are ways to navigate some of the pitfalls that belie the investment landscape.

There is clearly a size bias as larger funds continue to garner more limited partner (LP) capital than smaller vehicles, and these funds favor larger transactions. While this bias exists, I believe that small to middle-market companies may offer a more attractive investment option than their large-market peers because acquiring assets can be less expensive and often without a wide sale process. Additionally, the opportunity set within the lower middle market is much larger, allowing GPs to invest in valuable companies that have been overlooked due to the size and scope of the company’s operations. Strategic add-ons during their holding period often serve to further average down purchase multiples and add additional scale to these smaller companies. On the sale side, more natural buyers often exist. These companies are often targeted by larger market private equity funds both as platform investments and as add-on targets for existing portfolio companies. Strategic buyers have been active in the lower middle market as well, seeking growth and scale that can often be purchased more easily than building internally.

In the lower middle market, operationally-focused managers who are able to dig deep into companies, evaluate business efficiencies and recruit top talent can help platforms improve margins and streamline cash flows. GPs with backgrounds in specific industries such as healthcare, software or technology can also provide additional value through their networks and knowledge garnered through years of operational experience. Furthermore, these managers can run a thorough and efficient due diligence process and source unique investment opportunities that may not be known to a wider array of investors in the middle or upper middle market.

Key Takeaway

A substantial amount of private equity dry powder has been allocated to large buyout managers vying for the biggest companies in their respective industries. As a result, competition for deals among brand-name private equity investors is fierce, driving valuations to record highs. For LPs looking for value in their private equity portfolio, the lower middle market buyout space may be an option due to cheaper valuations, robust exit opportunities, as well as talented managers looking to put capital to work while still achieving attractive returns, albeit at lower dollar values than their larger private equity peers.

The material provided here is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.